Introduction

Are you struggling to navigate the often-chaotic world of altcoins, wondering when the next Bitcoin Dominance surge will signal an opportune moment to diversify? What if the key to unlocking hidden altcoin potential, especially during periods of quiet consolidation for Bitcoin, wasn’t in predicting the next big meme coin launch, but in understanding the subtle shifts in Bitcoin’s own market power? For many in the crypto space, observing Altcoin season excitement or the dizzying heights of meme coin rallies can be a distraction, pulling focus from a more fundamental indicator: Bitcoin Dominance. This metric, often overlooked by those chasing the next quick gain, holds profound secrets about the health and potential of the broader altcoin market.

In the dynamic universe of digital assets, where new tokens launch daily and meme coins capture imaginations with viral memes and community-driven hype, discerning true value can feel like searching for a needle in a haystack. Yet, beneath the surface-level noise, a powerful indicator of market sentiment and capital flow is constantly at play.

Crypto Market Overview

The cryptocurrency market is currently in a fascinating phase, characterized by significant price fluctuations and evolving investor sentiment. While Bitcoin tends to set the pace, the performance and interest in altcoins, meme coins, and airdrops paint a richer picture of market dynamics.

Currently, we’re observing a period of consolidation for Bitcoin, which can often precede significant movements in the broader altcoin market. This is a critical juncture for investors keen on capitalizing on the next Altcoin season. While Bitcoin’s dominance percentage fluctuates, its sheer market capitalization and established presence continue to influence capital allocation across the board. We’ve seen considerable interest in utility-focused altcoins that offer tangible use cases in areas like decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain gaming. Simultaneously, meme coins continue to attract speculative capital, often driven by social media trends and influencer endorsements, though their long-term viability remains a significant question mark.

The Core Concept: How Bitcoin Dominance Actually Works

To truly leverage the insights offered by Bitcoin Dominance, understanding its fundamental mechanics and what it represents is paramount. It’s not just a number; it’s a reflection of capital allocation and market sentiment within the digital asset space.

What Are Altcoins / Meme Coins / Airdrops?

To grasp the implications of Bitcoin Dominance, it’s essential to define the elements it influences:

Altcoins: An abbreviation for “alternative coins,” altcoins are any cryptocurrencies other than Bitcoin. They emerged as attempts to improve upon Bitcoin’s perceived limitations or to explore different use cases and technological advancements. Examples range from Ethereum, known for its smart contract capabilities, to Ripple (XRP) focused on cross-border payments, and countless others exploring DeFi, NFTs, supply chain management, and more. Altcoins represent the vast experimental playground of blockchain technology.

Meme Coins: These are cryptocurrencies that originated from internet memes, jokes, or cultural phenomena. While often lacking intrinsic utility or a robust development roadmap, meme coins can garner significant attention and value through social media hype, online communities, and celebrity endorsements. Their price action is typically driven by sentiment and speculation rather than underlying technology or fundamentals. Dogecoin and Shiba Inu are prime examples.

Airdrops: An airdrop is a marketing strategy where a cryptocurrency project distributes free tokens to a community of users, typically to early adopters, existing holders of another cryptocurrency (like holding a certain amount of ETH or BTC), or participants in promotional campaigns. The goal is usually to raise awareness, increase token distribution, and build a community around a new project.

Key Components & Technologies

The underlying technologies and tokenomics of altcoins and meme coins are diverse, but they often share core principles derived from Bitcoin’s foundational blockchain technology.

Blockchain Technology: Like Bitcoin, most altcoins operate on a decentralized ledger known as a blockchain. This distributed database records transactions across many computers, ensuring transparency, security, and immutability. Different altcoins may utilize various consensus mechanisms (e.g., Proof-of-Work (PoW), Proof-of-Stake (PoS), or hybrid models) that affect their energy consumption, transaction speed, and security.

Smart Contracts: A significant advancement introduced by Ethereum and adopted by many altcoins is the concept of smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. They automatically execute actions when predefined conditions are met, enabling the creation of decentralized applications (dApps), DeFi protocols, NFTs, and complex financial instruments without intermediaries.

Tokenomics: This refers to the economic design of a cryptocurrency, encompassing its supply (total, circulating, max), distribution mechanisms (e.g., ICOs, airdrops, mining rewards), utility within its ecosystem, and burning mechanisms. Sound tokenomics are crucial for long-term value appreciation and project sustainability, influencing demand and scarcity. Meme coins, in particular, often have hyper-inflated supplies or highly centralized token distributions, leading to extreme volatility.

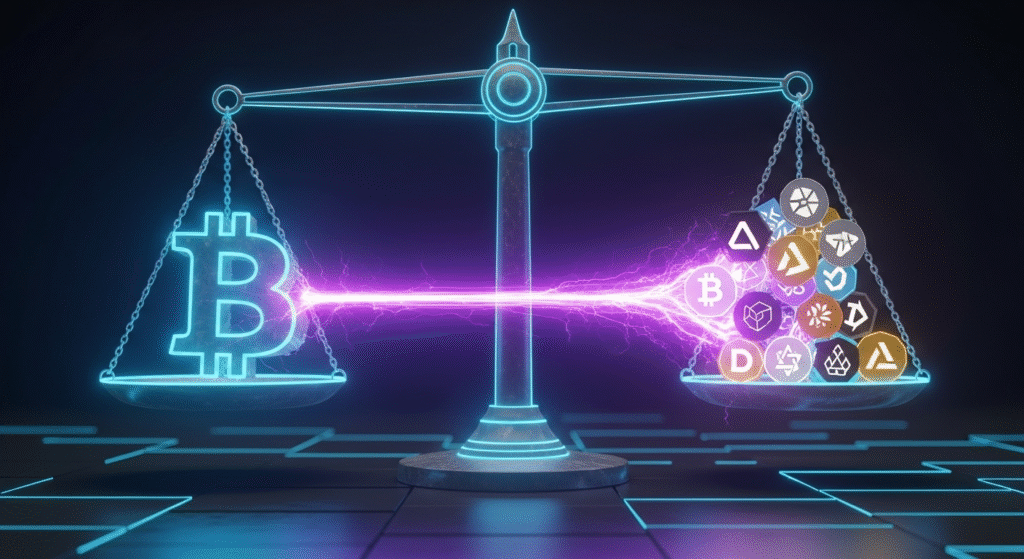

Understanding how Bitcoin Dominance interacts with these components is key. When Bitcoin Dominance is high, capital is perceived to be flowing into Bitcoin as the most stable and established cryptocurrency. When it falls, it suggests investors are feeling more optimistic and are willing to take on more risk by investing in altcoins, which have the potential for higher percentage gains.

The Data-Driven Perspective

The true power of Bitcoin Dominance as an analytical tool lies in its empirical data and the trends it reveals about the crypto market. By examining market data and understanding tokenomics, we can derive actionable insights.

Market Data & Trends

Bitcoin Dominance is calculated by dividing Bitcoin’s market capitalization by the total market capitalization of all cryptocurrencies, then multiplying by 100. A rising Bitcoin Dominance indicates that Bitcoin is outperforming altcoins, and capital is flowing from altcoins into Bitcoin. Conversely, a falling Bitcoin Dominance suggests that altcoins are gaining traction and absorbing capital, often signaling the start of an Altcoin season.

Historically, periods of high Bitcoin Dominance (often above 60-70%) are seen as accumulation phases for Bitcoin, with investors preferring its relative stability. As Bitcoin matures and its price movements become more predictable, capital often starts to flow into altcoins where higher percentage gains are anticipated. Peaks in Bitcoin Dominance have often been followed by significant rallies in altcoins. For instance, periods where Bitcoin Dominance dipped below 50% have historically coincided with major altcoin rallies.

Data analysis shows that while Bitcoin might experience steady growth, certain altcoins can achieve growth rates of several hundred percent during favorable market conditions. Meme coins, while exceptionally volatile, are almost entirely driven by sentiment, and their performance is a stark contrast to the more fundamental-driven growth of utility altcoins. Airdrops, if part of a well-executed strategy by a project, can boost early adoption and contribute to an altcoin’s initial traction, but their long-term impact is contingent on the project’s overall success.

Monitoring the correlation between Bitcoin Dominance and specific altcoin sectors (e.g., DeFi, NFTs, Layer-1 solutions) can reveal nuanced trends. For example, a falling Bitcoin Dominance might disproportionately benefit certain tech-focused altcoins before trickling down to more speculative meme coins.

Tokenomics & Market Health

The tokenomics of altcoins and meme coins play a crucial role in their long-term viability and how they are affected by shifts in Bitcoin Dominance.

Supply & Demand Dynamics: Altcoins with limited or deflationary token supplies, coupled with strong demand drivers (e.g., utility, staking rewards, governance), are generally better positioned to benefit from a decrease in Bitcoin Dominance. Their scarcity can amplify price movements when capital flows in. Meme coins, on the other hand, might have massive circulating supplies, making their price appreciation heavily reliant on continuous FOMO (Fear Of Missing Out) and burning mechanisms designed to reduce supply. A substantial increase in Bitcoin Dominance can signal a reallocation of speculative capital away from these riskier assets.

Token Utility: Altcoins with clear use cases and integrated utility within their ecosystems tend to be more resilient and attractive during market downturns or periods of shifting sentiment. This utility creates organic demand. Meme coins, lacking this, are purely speculative. The health of a meme coin’s community and its ability to maintain hype are its primary “tokenomics.”

Vesting Schedules & Distribution: How tokens are initially distributed and vested can significantly impact their market performance. If a large portion of tokens is held by early investors or the founding team, it can create selling pressure if those holders decide to exit, especially when Bitcoin Dominance increases and risk aversion rises. This is especially true for new altcoins and airdrop recipients looking to realize profits.

Analyzing these aspects alongside Bitcoin Dominance provides a more holistic view. For instance, if Bitcoin Dominance is falling, but an altcoin’s tokenomics suggest a high inflation rate or significant unlock events, its potential rally might be capped or even reversed by internal selling pressure. Conversely, an altcoin with a well-defined buyback and burn mechanism, combined with falling Bitcoin Dominance, presents a compelling opportunity.

Risks, Challenges & Competition

While the allure of altcoins and meme coins is undeniable, especially when Bitcoin Dominance starts to wane, it’s crucial to acknowledge the inherent risks and competitive landscape.

Risks of Altcoins and Meme Coins

Investing in altcoins and meme coins, particularly during periods of transition indicated by Bitcoin Dominance, carries significant risks:

Volatility: Altcoins, and especially meme coins, are significantly more volatile than Bitcoin. Their prices can experience dramatic swings in short periods, leading to substantial gains or catastrophic losses. This volatility is often amplified by lower liquidity, meaning larger buy or sell orders can have a more pronounced impact on price.

Security Vulnerabilities: Many altcoins and DeFi projects are still relatively nascent. They can be susceptible to smart contract exploits, hacks, and rug pulls (where developers abandon a project and abscond with investor funds). The decentralized nature that provides freedom also creates potential entry points for malicious actors.

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving globally. Altcoins, with their diverse functionalities and uses, could face different regulatory treatments than Bitcoin. Increased scrutiny or adverse regulations could significantly impact their value and adoption.

Lack of Fundamentals (Meme Coins): Meme coins, by their very nature, often lack strong underlying technology, development teams, or real-world use cases. Their value is almost entirely based on speculative interest and social media hype, making them extremely prone to sudden collapses once the hype fades or a new trend emerges.

Market Manipulation: Due to lower liquidity and often less sophisticated market participants, altcoins, and especially meme coins, can be more easily susceptible to pump-and-dump schemes.

How Does Bitcoin Dominance Stack Up Against Competitors?

When we talk about “competitors” in the context of Bitcoin Dominance, it’s important to distinguish between Bitcoin’s role as a store of value and its influence on altcoin adoption. Bitcoin Dominance itself isn’t a competitor; it’s an indicator of Bitcoin’s relative strength. However, the performance of altcoins directly “competes” for capital with Bitcoin.

| Feature | Bitcoin | Altcoins (General) | Meme Coins |

|---|---|---|---|

| Primary Use Case | Store of Value, Digital Gold | Diverse: Smart Contracts, DeFi, NFTs, Payments, etc. | Speculation, Community, Social Media Trends |

| Volatility | High, but generally lower than altcoins | Very High | Extremely High |

| Market Cap | Largest | Varies greatly, from billions to millions | Can fluctuate wildly, often driven by hype |

| Perceived Risk | Relatively Lower (compared to altcoins) | Higher | Very High |

| Development Focus | Security, Scalability, Store of Value | Innovation, New Features, Niche Use Cases | Community engagement, viral marketing, meme creation |

| Capital Flow Signal | High Bitcoin Dominance = Flight to safety/consolidation | Falling Bitcoin Dominance = Risk-on, Altcoin interest | Often follow altcoin trends or operate independently driven by pure hype |

Understanding this competitive landscape helps in interpreting shifts in Bitcoin Dominance. When Bitcoin Dominance falls, it suggests investors are comfortable moving capital from Bitcoin into assets with higher growth potential. However, the risks associated with those altcoins, particularly meme coins, remain substantial.

The Future Outlook

The interplay between Bitcoin Dominance and the altcoin market is not static; it evolves with technological advancements, market sentiment, and regulatory shifts. Understanding these future trends is crucial for any investor looking to capitalize on the crypto ecosystem.

What’s Next for Altcoins / Meme Coins / Airdrops?

The future of altcoins, meme coins, and airdrops will likely be shaped by several key factors:

Technological Maturation: As blockchain technology matures, we can expect altcoins to offer increasingly sophisticated solutions in areas like layer-2 scaling for faster transactions, zero-knowledge proofs for enhanced privacy, and improved interoperability between different blockchains. This will likely lead to a more discerning investor base, favoring altcoins with demonstrable utility and robust technology over speculative hype, especially when Bitcoin Dominance trends are observed.

Regulatory Clarity: Increased regulatory clarity, while potentially introducing compliance hurdles, could also lead to greater institutional adoption and mainstream acceptance of altcoins. Projects that actively engage with regulators and demonstrate robust compliance frameworks may see their value appreciation accelerate.Conversely, projects that fail to adapt could face significant challenges.

The Evolution of Meme Coins: Meme coins may continue to exist as a speculative niche, but their long-term relevance might hinge on their ability to integrate some form of utility or community governance that provides sustainable value. Without it, they remain highly susceptible to narrative shifts and may be the first to lose ground when Bitcoin Dominance starts to rise, indicating a return to more conservative crypto investments.

Sophistication of Airdrops: Airdrop strategies will likely become more sophisticated. Projects will aim for more meaningful engagement, potentially rewarding users for contributing to the ecosystem (e.g., participating in DeFi protocols, testing new features, or engaging with content) rather than just holding or transferring coins. This could lead to more targeted and valuable airdrops.

DeFi and NFTs Integration: The integration of DeFi and NFT functionalities within various altcoins will continue to blur the lines between different crypto sectors. Altcoins that successfully bridge these areas with real-world applications are likely to lead the next wave of innovation and investment.

In essence, as the crypto market matures, driven by the overarching influence of Bitcoin Dominance, we will likely see a greater emphasis on fundamental value, utility, and robust technology. While speculation will always play a role, particularly with meme coins, the discerning investor will look for projects that demonstrate long-term sustainability, often signaled by subtle shifts alongside Bitcoin Dominance.

Conclusion

Navigating the cryptocurrency market can be an exhilarating, yet challenging, endeavor. By understanding the nuanced signals embedded within Bitcoin Dominance, you gain a powerful lens through which to view the opportunities and risks inherent in altcoins, meme coins, and airdrops. We’ve seen how Bitcoin Dominance isn’t just a Bitcoin metric; it’s a crucial indicator of capital flow and risk sentiment across the entire digital asset landscape. Observing its trends can help you anticipate potential Altcoin season rallies or identify periods where a return to Bitcoin might be prudent.

From understanding the core concepts of altcoins and meme coins to analyzing market data and tokenomics, the journey to informed crypto investing is paved with data. Remember the inherent volatility and the importance of security, especially with newer or more speculative assets. The future promises further innovation, greater institutional involvement, and a more defined regulatory environment, all of which will continue to shape the narrative around Bitcoin and its impact on the broader altcoin market.

What are your thoughts on the current state of Bitcoin Dominance and its implications for altcoins? Do you have any particularly interesting altcoin or meme coin strategies you’d like to share, perhaps tied to observing these dominance shifts? We encourage you to engage in the comments below to share your insights, questions, and experiences. For more in-depth analysis and up-to-the-minute crypto strategies, be sure to subscribe to our newsletter and explore our other articles on [link to related content 1] and [link to related content 2]!

FAQs

1. What is the ideal Bitcoin Dominance level to consider investing in altcoins?

There isn’t a single magic number, but many traders look for a declining Bitcoin Dominance as a signal that capital is rotating into altcoins. Historically, levels below 50% have often preceded strong altcoin rallies. However, it’s crucial to combine this with analysis of individual altcoins’ fundamentals and market trends.

2. Are meme coins a good investment when Bitcoin Dominance falls?

Meme coins are extremely speculative. While they can see explosive growth during periods of high risk appetite (often coinciding with falling Bitcoin Dominance), they are also prone to sudden and severe crashes. Treat them as high-risk, high-reward bets and never invest more than you can afford to lose.

3. How do airdrops factor into Bitcoin Dominance trends?

Airdrops are primarily a distribution and marketing tool. While a successful airdrop can boost an altcoin’s initial traction, its long-term performance and susceptibility to shifts in Bitcoin Dominance will depend on the project’s underlying value proposition and market sentiment.

4. Can Bitcoin Dominance predict the exact timing of an Altcoin season?

While Bitcoin Dominance is a strong indicator of sentiment, it’s not a perfect predictor of timing. It’s best used in conjunction with other technical and fundamental analysis tools to assess opportunities.

5. What are the biggest risks of investing in altcoins compared to Bitcoin?

Altcoins generally carry higher volatility, greater susceptibility to market manipulation, potential security vulnerabilities in their underlying technology, and a more uncertain regulatory future compared to Bitcoin.