Are you missing out on the next big altcoin surge, feeling like the crypto market is a secret society you haven’t been invited to? In a landscape where Bitcoin and Ethereum often steal the spotlight, discerning investors are increasingly looking to lesser-known yet powerful projects for significant returns. But how do you cut through the noise and identify the real gems? In this comprehensive guide, we’re pulling back the curtain on a groundbreaking platform, revealing Near Protocol: 5 Secrets for Altcoin Investors to help you navigate the exciting world of emergent digital assets. We’ll delve into the data, explore the technology, and equip you with the knowledge to make informed decisions in the dynamic world of cryptocurrency.

Crypto Market Overview

The cryptocurrency market is a perpetual motion machine, constantly evolving and presenting new opportunities. While the dominant narratives surrounding Bitcoin’s price action and Ethereum’s upcoming upgrades persist, the altcoin sector has been quietly buzzing with innovation and growth. Recently, we’ve witnessed a resurgence in interest for layer-1 blockchains that offer unique solutions to scalability, usability, and developer experience. This has led to significant price appreciation in several promising altcoins, as investors recognize the potential for these networks to capture market share.

The Core Concept: How Near Protocol Actually Works

At its heart, understanding the value proposition of a cryptocurrency lies in grasping its underlying technology and purpose. For those new to the space, the sheer volume of projects can be overwhelming.

What Are Altcoins?

Essentially, “altcoin” is a term used to describe any cryptocurrency other than Bitcoin. The very first altcoin was Namecoin, launched in 2011. Since then, thousands of altcoins have emerged, each with its own unique features, use cases, and underlying technology. While some altcoins are mere copycats of Bitcoin, many are built on innovative blockchain architectures designed to improve upon Bitcoin’s perceived limitations, such as transaction speed, energy consumption, or smart contract capabilities.

Meme coins, a sub-category of altcoins, are often inspired by internet jokes, memes, or cultural trends. Their value is typically driven by community sentiment, social media buzz, and speculative trading rather than fundamental utility, though some are attempting to build ecosystems around their communities.

Airdrops, on the other hand, are marketing strategies employed by crypto projects. They involve distributing free tokens to existing holders of other cryptocurrencies (like Bitcoin or Ethereum) or to users who perform specific tasks (like following a project on social media or joining their Telegram channel). Airdrops are a way for new projects to gain visibility, attract users, and decentralize their token distribution.

Key Components & Technologies of Near Protocol

Near Protocol (often referred to as the Near Altcoin) distinguishes itself through its innovative technical architecture designed for mainstream adoption. It’s a sharded, proof-of-stake (PoS) blockchain that aims to solve the scalability and usability issues that have plagued earlier blockchain generations.

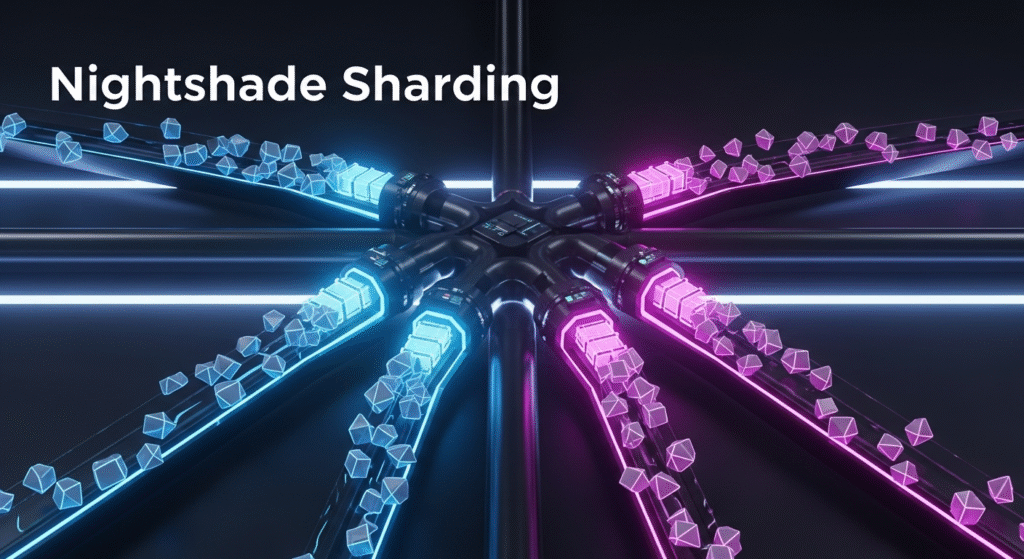

Sharding (Nightshade): This is perhaps the most critical innovation of Near Protocol. Nightshade is a unique sharding design that splits the blockchain into multiple shards, allowing these shards to process transactions and execute smart contracts in parallel. Unlike some other sharded blockchains, Nightshade shards only need to store the state of their own shard, making it more efficient. This parallel processing dramatically increases the network’s transaction throughput (transactions per second) without compromising security or decentralization. The network can dynamically adjust the number of shards based on demand.

Doomslug Finality Gadget: Near Protocol utilizes Doomslug to achieve fast transaction finality. This mechanism ensures that once a transaction is included in a block, it is considered final very quickly, minimizing the risk of double-spending and improving the user experience for applications built on the network.

Account Model & Human-Readable Account Names: Near Protocol moves away from the complex hexadecimal addresses typical of many blockchains. Instead, it supports human-readable account names (e.g., “yourname.near”). This significantly enhances usability for everyday users who may not be deeply familiar with blockchain technology, making it easier to send and receive tokens and interact with dApps.

Developer-Friendly Environment: Near Protocol is built to be accessible to developers. It supports multiple programming languages for smart contract development, including familiar ones like JavaScript, TypeScript, and Rust. This lowers the barrier to entry for developers, encouraging more innovation and the creation of diverse applications on the network.

Progressive Online Security (POS): The network’s consensus is secured by a dynamically sized validator set that is randomly reshuffled at each epoch. This “progressive online security” model helps prevent collusion and ensures a high level of decentralization and security. Validators are selected based on their staked NEAR tokens and are incentivized to act honestly.

The Data-Driven Perspective

To truly understand the investment potential of a cryptocurrency, we must look beyond the hype and examine the concrete data and underlying tokenomics.

Market Data & Trends

Analyzing recent market data reveals a compelling narrative for Near Protocol and its ecosystem. As of early-to-mid 2024, the total supply of NEAR tokens utilized and circulating has seen steady growth, indicating increasing adoption and staking within the network. Developer activity on Near Protocol has also been on an upward trajectory, with a significant increase in the number of active developers and deployed contracts. This surge in developer engagement is a strong indicator of a healthy and growing ecosystem, suggesting that new dApps and services are continually being built on the platform.

When we look at the broader altcoin market, trends indicate a rotation of capital into layer-1 solutions that offer enhanced scalability and lower transaction fees. Near Protocol, with its sharded architecture, is well-positioned to benefit from this trend. Compared to older blockchains that often struggle with congestion and high gas fees, Near Protocol offers a more cost-effective and efficient environment for users and developers alike. The growing Total Value Locked (TVL) in DeFi protocols built on Near Protocol also signifies increased user confidence and participation in its decentralized finance offerings. Furthermore, the network’s unique Rainbow Bridge, which allows seamless asset transfers between Near Protocol and Ethereum, has facilitated cross-chain liquidity and expanded the reach of its ecosystem.

Tokenomics & Market Health of NEAR

The tokenomics of Near Protocol are designed to incentivize network participation, security, and long-term growth.

NEAR Token Utility: The native NEAR token serves several critical functions within the ecosystem:

- Transaction Fees: Users pay transaction fees in NEAR.

- Staking: Validators stake NEAR to secure the network and earn rewards. Delegators can also stake NEAR with validators to earn a portion of the rewards.

- Governance: As the network evolves, NEAR tokens will play a role in on-chain governance, allowing token holders to vote on protocol upgrades and changes.

Supply & Distribution: The initial supply of NEAR tokens was allocated to various stakeholders, including the foundation, early investors, community grants, and ecosystem development. A portion is also allocated for staker rewards, ensuring continuous network security. The token supply inflation is managed through predictable staking rewards, which are balanced by transaction fee burns. This mechanism aims to maintain the scarcity and value of the NEAR token over time.

Inflationary vs. Deflationary Pressures: While staking rewards introduce inflation, transaction fees collected by the network are subject to a burn mechanism. If the amount of NEAR burned through transaction fees exceeds the amount issued as staking rewards, the token can become deflationary, potentially increasing its value. This dynamic interplay between issuance and burning is a key aspect of the token’s long-term economic sustainability.

Market Capitalization & Liquidity: As of its listing on major exchanges, Near Protocol has established a significant market capitalization, reflecting investor confidence and widespread adoption. High liquidity on these exchanges ensures that investors can buy and sell NEAR tokens efficiently, contributing to price stability and accessibility. The growing number of DeFi applications and the increasing use of the NEAR token within these applications further contribute to its demand and perceived value.

Risks, Challenges & Competition

No cryptocurrency project is without its inherent risks and challenges, and Near Protocol is no exception. Understanding these potential pitfalls is crucial for a balanced investment strategy.

Risks of Altcoins and Near Protocol

Market Volatility: Like all cryptocurrencies, Near Protocol‘s price is subject to extreme volatility. The broader crypto market, as well as specific events impacting the Near Altcoin, can lead to rapid and significant price swings, posing a risk to investors’ capital.

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving globally. New regulations or crackdowns could impact the development, adoption, and value of Near Protocol and its associated tokens.

Technical Risks & Exploits: Despite robust security measures, blockchain platforms can be susceptible to technical bugs, network exploits, or smart contract vulnerabilities. While Near Protocol has a strong focus on security, the introduction of new features or the complexity of smart contracts can, in rare cases, lead to unforeseen issues.

Adoption & Network Effects: The success of a blockchain platform heavily relies on its adoption by developers and users. If Near Protocol fails to attract a substantial ecosystem of dApps and a large user base, its long-term viability could be jeopardized. Competition is fierce, and maintaining network effects is a continuous challenge.

Centralization Concerns (Potential): While Near Protocol is designed with decentralization in mind, any blockchain can face temporary or long-term centralization risks, depending on the distribution of validator nodes and token ownership. Continuous monitoring of the network’s decentralization metrics is important.

How Does Near Protocol Stack Up Against Competitors?

Near Protocol operates in a highly competitive space, often categorized alongside other layer-1 blockchains striving for scalability and developer adoption. Here’s a comparison against some key players:

| Feature | Near Protocol | Ethereum (Post-Merge) | Solana | Avalanche |

|---|---|---|---|---|

| Consensus | Proof-of-Stake (PoS) with Doomslug | Proof-of-Stake (PoS) Proof-of-Stake | Proof-of-Stake (PoS) Proof-of-History (PoH) | Proof-of-Stake (PoS) Snowman/Avalanche consensus |

| Scalability | Sharded (Nightshade) – High TPS | Sharded (Post-Merge) – Improving TPS | High TPS (though can face periods of congestion) | High TPS via Subnets |

| Transaction Fees | Low | Moderate to High (varies greatly) | Very Low | Low |

| Finality | Fast (Doomslug) | Fast (Casper FFG) | Very Fast | Fast |

| Developer Ease | High (JS, TS, Rust) | Moderate (Solidity) | Moderate (Rust, C++) | Moderate (Solidity, custom VMs) |

| Smart Contracts | Yes | Yes | Yes | Yes |

| Ecosystem Focus | Usability, developer experience, mainstream adoption | DeFi, NFTs, broad dApp development | High-frequency trading, DeFi, NFTs, gaming | DeFi, enterprise, customizable blockchains (subnets) |

| Tokenomics | Staking rewards, fee burns | Staking rewards, EIP-1559 fee burn (deflationary potential) | Staking rewards, transaction fees | Staking rewards, transaction fees |

Key Differentiators for Near Protocol:

- Unmatched Developer Experience: The emphasis on familiar programming languages and human-readable accounts is a significant advantage in attracting developers and simplifying user interaction.

- Efficient Sharding: Nightshade’s design is considered highly efficient, allowing for seamless scaling with minimal disruption.

- Focus on Usability: Near Protocol actively prioritizes user experience, aiming to make blockchain technology as accessible as traditional web applications.

While Ethereum remains the dominant smart contract platform, and Solana boasts incredible speed, Near Protocol is carving out its niche by offering a compelling balance of scalability, developer friendliness, and user accessibility, making it a noteworthy Near Altcoin for consideration.

The Future Outlook

The trajectory of cryptocurrencies, particularly altcoins, is often dictated by technological advancements, market adoption, and evolving user needs. For Near Protocol, the future looks promising, fueled by its robust technology and strategic development.

What’s Next for Near Protocol?

The roadmap for Near Protocol is ambitious and focused on several key areas:

Continued Shard Optimization: As network usage increases, Near Protocol will continue to refine and potentially expand its Nightshade sharding implementation to maintain high throughput and low fees. This includes optimizing inter-shard communication.

EVM Compatibility: A significant ongoing development is the introduction of an Ethereum Virtual Machine (EVM) compatibility layer. This will allow developers to easily migrate their existing Ethereum dApps to Near Protocol, leveraging its performance benefits without a complete rewrite. This move is expected to significantly boost the number of applications and users on the network.

Meta-transactions and Account Abstraction: To further enhance usability, Near Protocol is implementing features like meta-transactions, which allow dApps to pay transaction fees on behalf of their users. This eliminates the need for users to hold native tokens just to interact with an application, paving the way for truly seamless Web3 experiences.

Ecosystem Growth & Grants: The NEAR Foundation continues to actively support developers and projects building on Near Protocol through grants and funding initiatives. This commitment to fostering a vibrant ecosystem is crucial for its long-term success.

Interoperability Solutions: Beyond its Rainbow Bridge to Ethereum, Near Protocol is exploring further interoperability solutions with other blockchain networks, aiming to become a more interconnected part of the broader decentralized web.

The general outlook for altcoins remains one of cautious optimism. As the crypto market matures, investors are increasingly discerning, favoring projects with strong technological foundations, clear use cases, and active developer communities. Layer-1 blockchains like Near Protocol, which address fundamental scalability and usability challenges, are well-positioned to capture significant market share. Furthermore, the growing institutional interest in digital assets and the expanding use cases for blockchain technology across various industries suggest a continued upward trend for well-executed altcoin projects. The rise of decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs) all rely on efficient and scalable blockchain infrastructure, where Near Protocol aims to be a leader.

Conclusion

Navigating the intricate world of altcoins can feel like searching for a needle in a haystack, but by understanding the underlying technology, analyzing market data, and recognizing the strategic advantages of specific projects, you can make more informed investment decisions. Near Protocol stands out as a powerful contender in the layer-1 blockchain space, offering a compelling blend of scalability, developer-friendliness, and user-centric design.

We’ve uncovered five key secrets for investors looking at Near Protocol: its innovative sharding technology (Nightshade), the ease of use provided by human-readable accounts and lower fees, its robust tokenomics designed for long-term sustainability, its strong ecosystem growth driven by developer adoption, and its future-proofing through initiatives like EVM compatibility.

By understanding these facets, you’re better equipped to assess the potential of the Near Altcoin and other similar projects. The crypto market is dynamic, and continuous learning is key.

What are your thoughts on Near Protocol? Have you invested in NEAR or explored its ecosystem? Share your insights in the comments below! For more deep dives into promising altcoins and cryptocurrency strategies, be sure to subscribe to our newsletter and check out our other articles on [Link to related blog post on altcoin strategies] and insights into [Link to another relevant crypto topic].

FAQs

Q1: Is Near Protocol considered a good investment?

Near Protocol is considered by many to be a promising investment due to its strong technological foundation, focus on developer experience, and increasing ecosystem adoption. However, like all cryptocurrencies, NEAR is subject to market volatility. Investors should conduct thorough due diligence and consider their own risk tolerance before investing.

Q2: What makes Near Protocol different from other blockchains like Ethereum or Solana?

The key differentiators for Near Protocol include its unique sharding architecture called Nightshade, which allows for high transaction throughput and scalability. It also emphasizes user-friendliness with human-readable account names and lower transaction fees compared to many established blockchains. While Ethereum is the established leader, and Solana offers extreme speed, Near Protocol aims for a balance of scalability, ease of use, and developer accessibility.

Q3: How can I earn passive income with Near Protocol?

You can earn passive income by staking NEAR tokens with validators on the network. By staking your NEAR, you help secure the network and receive staking rewards in return. You can also earn by providing liquidity to DeFi protocols built on Near Protocol, though this often carries higher risks.

Q4: What are the main risks of investing in the Near Altcoin?

The primary risks include general cryptocurrency market volatility, potential regulatory changes affecting digital assets, technical risks or security exploits (though Near Protocol has strong security measures), and the challenge of achieving widespread adoption and network effects against strong competitors.

Q5: How does Near Protocol’s sharding work?

Near Protocol uses a sharding mechanism called Nightshade. This divides the blockchain into smaller, parallel chains (shards) that can process transactions and smart contracts simultaneously. This parallel processing significantly enhances the network’s capacity and allows it to scale efficiently as more users and applications join.