Safemoon Drama: Why This Altcoin Stirred Chaos

Hashtag-driven hype, astronomical price surges, and sudden, dramatic crashes – these are the hallmarks of the volatile world of meme coins. But what happens when the speculation transcends the digital realm and spills into accusations of deception and financial ruin? In the cryptocurrency landscape, where fortunes can be made and lost in the blink of an eye, few narratives have captivated and confounded observers quite like the **Safemoon Drama. This altcoin, once a supernova of community-driven enthusiasm, eventually found itself at the epicenter of controversy, leaving many investors questioning the very fabric of nascent digital assets.

Crypto Market Overview

The cryptocurrency market, a perpetual motion machine of innovation and speculation, is currently in a fascinating phase. While Bitcoin and Ethereum continue to dominate headlines, the altcoin sector is experiencing a dynamic resurgence. We’re witnessing a shift from purely speculative meme coins towards utility-driven altcoins that leverage novel blockchain technologies and offer tangible solutions. During the last bull run, meme coins like Dogecoin and Shiba Inu captured the collective imagination, demonstrating the power of community and virality. However, this has evolved.

Currently, market indicators suggest a growing interest in altcoins with strong fundamental use cases, advancements in decentralized finance (DeFi), and innovative approaches to tokenomics. Airdrops, in particular, continue to be a popular strategy for new projects to distribute tokens and build community, though their effectiveness and legitimacy are increasingly under scrutiny. Data from CoinMarketCap reveals that the total market capitalization for altcoins has seen significant fluctuations, often mirroring Bitcoin’s movements but with amplified volatility. For instance, the past year has seen periods where altcoins collectively outperformed Bitcoin, followed by sharp corrections. This inherent volatility makes understanding the underlying technology and project roadmap crucial, especially when evaluating the potential for long-term growth beyond meme-driven pumps.

The Core Concept: How Safemoon Actually Works

To understand the Safemoon Drama, it’s imperative to grasp the foundational principles of Safemoon itself, along with the broader categories it belonged to.

What Are Altcoins / Meme Coins / Airdrops?

Let’s break down these terms:

- Altcoins: Simply put, “altcoins” are any cryptocurrencies other than Bitcoin. Bitcoin, as the first and most dominant cryptocurrency, set the precedent. All other digital currencies that emerged afterward are considered altcoins. They can range from established giants like Ethereum, which powers smart contracts and decentralized applications, to niche tokens with specific functionalities. The diversity within altcoins is vast, encompassing everything from utility tokens and security tokens to stablecoins and, of course, meme coins.

- Meme Coins: These are a subset of altcoins that are often created as a joke or inspired by internet memes. Their value is frequently driven by social media trends, community sentiment, and speculation rather than intrinsic utility or underlying technology. While some meme coins have managed to achieve significant market capitalization (e.g., Dogecoin), they are inherently high-risk investments due to their speculative nature. Safemoon famously falls into this category, using a community-centric approach and leveraging meme culture for promotion.

- Airdrops: An airdrop is a marketing tactic used by blockchain projects to distribute tokens to cryptocurrency users for free. It’s often used to raise awareness, attract new users, or reward existing token holders. Projects might airdrop tokens to holders of a specific cryptocurrency (like ETH or BTC), users who interact with a particular decentralized application (dApp), or simply to anyone who signs up for a newsletter or follows their social media accounts. While airdrops can be a legitimate way to gain exposure to new projects, they can also be a vector for scams, with fake airdrops designed to steal user data or private keys.

Key Components & Technologies

Safemoon, like many altcoins, was built on blockchain technology. Specifically, it operated on the Binance Smart Chain (BSC), now known as the BNB Smart Chain. This choice was strategic, as BSC offered lower transaction fees and faster transaction speeds compared to the Ethereum network at the time.

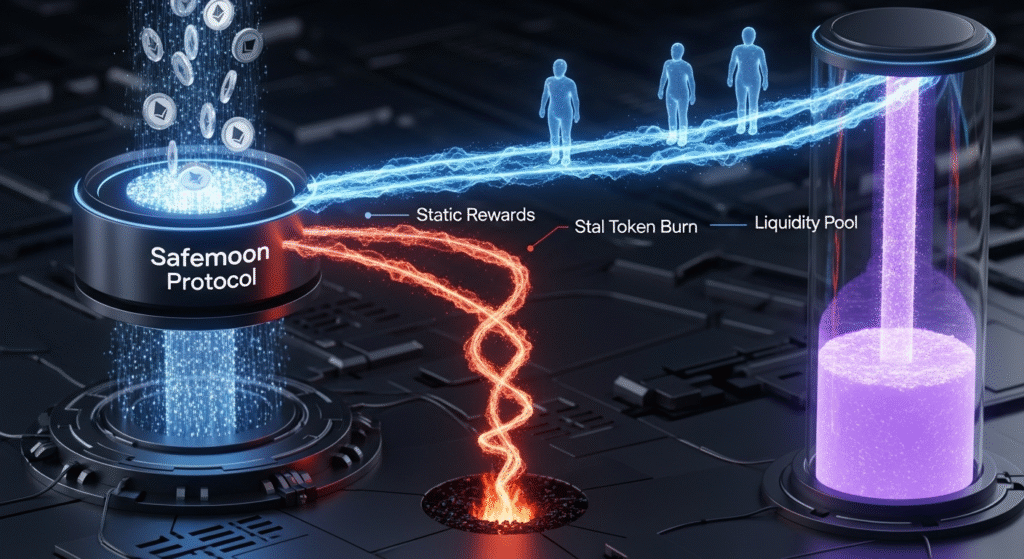

Safemoon’s core innovation, or at least its most heavily marketed feature, revolved around its unique tokenomics:

- Static Rewards: A portion of every transaction made with Safemoon was redistributed proportionally to existing Safemoon holders. The longer you held the token, the more you theoretically earned from subsequent transactions. This incentivized holding.

- Manual Safemoon: Another portion of each transaction was “burned” – permanently removed from circulation. This deflationary mechanism was intended to reduce the total supply over time, thereby increasing the scarcity and potentially the value of remaining tokens.

- Liquidity Pool (LP) Acquisition: A third part of each transaction was sent to a liquidity pool. This pool provided the necessary tokens for exchanges to facilitate trading, ensuring the token could be bought and sold.

These mechanisms, while seemingly designed to benefit holders, also created a complex interplay of incentives and potential pitfalls, particularly as the project grew in popularity and its creators faced scrutiny.

The Data-Driven Perspective

Understanding the Safemoon Drama requires a look at the data – both the initial surges and the subsequent trends that raised red flags.

Market Data & Trends

When Safemoon launched in March 2021, its ascent was nothing short of meteoric. Riding the wave of meme coin fever that had propelled Dogecoin and Shiba Inu to new heights, Safemoon experienced exponential growth. Within weeks of its launch, its market capitalization soared into the billions of dollars. Millions of holders flocked to the token, attracted by the promise of passive income through static rewards and the potential for astronomical gains.

On its peak, Safemoon’s market cap reportedly reached over $7 billion. Price charts displayed parabolic curves, a testament to the sheer buying pressure driven by community hype and speculative trading. However, this rapid ascent was unsustainable. Analysis of trading volume reveals periods of intense activity followed by sharp declines. While the token experienced numerous “pump” events, likely fueled by coordinated community efforts and influencer marketing, these were often followed by significant “dumps,” as early investors and a select few cashed out, leaving many retail investors holding tokens with significantly diminished value.

The data also highlighted concerning trends in liquidity. As more tokens were locked into the liquidity pool to facilitate trading, there was a risk that a large sell-off could drain the pool, making it difficult for others to exit their positions. Furthermore, detailed on-chain analytics from various blockchain explorers often showed large, concentrated holdings by wallets associated with the project’s founders or early insiders, raising questions about potential market manipulation. The sheer volume of transactions, while impressive, also led to concerns about network congestion and fees on the BNB Smart Chain, though this was largely a consequence of the chain’s popularity rather than an inherent flaw in Safemoon’s model itself.

Tokenomics & Market Health

Safemoon’s tokenomics were designed to be a core differentiator, offering static rewards and automatic burning, which are attractive concepts for investors seeking passive income and deflationary assets. The initial distribution, however, also raised questions. A significant portion of tokens was often held by the project team, which, while common, can present a risk if these tokens are dumped onto the market.

The tokenomics model, while theoretically sound for encouraging long-term holding, also created an environment where small price movements could result in large percentage gains or losses for holders due to the redistribution mechanism. For newcomers, this could be confusing, as their wallet balance might appear to increase even if the token’s net price was falling, due to the earned reflections.

From a market health perspective, the reliance on continuous new buying pressure to sustain the token distribution was a critical vulnerability. If the influx of new investors slowed, the rewards for existing holders would decrease, potentially leading to a downward spiral. The effectiveness of the manual burn mechanism, while reducing supply, was largely dependent on the volume of transactions. In scenarios of low trading activity, the deflationary pressure would be minimal.

The sustainability of such a model hinged on constant community engagement and marketing, which Safemoon excelled at initially. However, true long-term market health typically relies on the development and adoption of a tangible product or service that creates real demand for the token, something that Safemoon struggled to demonstrate consistently.

Risks, Challenges & Competition

The meteoric rise of Safemoon also brought with it significant risks, intense scrutiny, and a competitive landscape that demanded more than just hype.

Risks of Altcoins and Meme Coins

Investing in altcoins, and particularly meme coins, comes with a distinct set of risks that investors must understand:

- Extreme Volatility: Meme coins are highly susceptible to rapid and dramatic price swings. Driven by sentiment and viral trends, their value can skyrocket and plummet with little warning, often detached from any fundamental underlying value. This makes them incredibly risky for investors seeking stable growth. The Safemoon scam allegations often stemmed from these volatile price movements and perceived manipulation.

- Lack of Utility: Many meme coins, including Safemoon in its early stages, lack a concrete use case. Their value is derived primarily from speculation and community belief. Without a genuine utility, the token’s long-term viability is questionable, making them vulnerable to losing all value if investor interest wanes.

- Rug Pulls and Scams: The ease with which new tokens can be created and launched on platforms like BSC has unfortunately led to an increase in fraudulent schemes. “Rug pulls” occur when developers abandon a project, taking all investor funds with them. The lack of regulation in the crypto space exacerbates these risks.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving. Governments worldwide are grappling with how to regulate digital assets, and potential future regulations could significantly impact the value and legality of certain altcoins and meme coins.

- Security Vulnerabilities: While blockchain technology is generally secure, smart contract code can contain vulnerabilities. An exploit in a token’s smart contract could lead to the theft of funds or the devaluing of the token.

How Does Safemoon Stack Up Against Competitors?

Safemoon entered a crowded altcoin market. Here’s a brief comparison with other prominent meme coins and utility-focused altcoins of its era:

| Feature | Safemoon | Dogecoin (DOGE) | Shiba Inu (SHIB) | Ethereum (ETH) |

|---|---|---|---|---|

| Primary Focus | Community, static rewards, burning | Meme, community, store of value (playful) | Meme, community, ecosystem (DeFi, NFTs) | Smart contracts, dApps, DeFi, NFTs |

| Tokenomics Innovation | Static rewards, manual burn, LP acquisition | Inflationary, fixed block reward | Highly deflationary (token burns), staking | Proof-of-Stake (PoS) after merge, gas fees |

| Utility | Limited, focus on internal exchange development | Primarily a payment/tipping currency | Growing ecosystem: Shibarium, NFTs, Metaverse | Foundation for a vast decentralized ecosystem |

| Community Strength | Very strong, cult-like following | Strong, long-standing meme culture | Extremely strong, organic growth | Large, developer-centric, diverse user base |

| Risk Profile | Very High (Meme coin, early controversy) | High (Meme coin, some utility) | Very High (Meme coin, developing utility) | Medium-High (Large cap, but volatile) |

| Regulatory Scrutiny | High (due to performance and allegations) | Moderate (recognized as a digital currency) | Moderate (similar to Doge) | High (subject to financial regulations) |

While Safemoon aimed to differentiate through its unique tokenomics, its rapid rise and subsequent controversies placed it in a high-risk category, particularly when compared to more established meme coins like Dogecoin or even Shiba Inu, which began building a broader ecosystem. For investors seeking utility and long-term growth, established platforms like Ethereum represented a fundamentally different investment class altogether, offering robust technology and a vast network of applications. The Safemoon Drama highlighted how community hype alone, without a solid foundation, could lead to significant investor disappointment.

The Future Outlook

The Safemoon Drama, with its accusations and founder departures, has undoubtedly cast a long shadow. However, it also serves as a valuable case study for the broader altcoin and meme coin markets.

What’s Next for Altcoins / Meme Coins / Airdrops?

The future of altcoins, meme coins, and airdrops will likely be shaped by several key trends:

- Maturation of the Meme Coin Sector: While the wild west days of pure speculative meme coins might be waning, expect to see more sophisticated iterations. Projects that can demonstrate a clear roadmap, community governance, and increasingly, some form of utility beyond just being a meme, are more likely to survive and thrive. The focus may shift from purely viral marketing to sustainable community building and tangible product development.

- Increased Scrutiny and Regulation: As the crypto market grows, so does the attention from regulators. Projects that are transparent, adhere to best practices, and focus on user protection are more likely to navigate the evolving regulatory landscape successfully. This scrutiny will also likely lead to fewer outright scams.

- Utility-Driven Altcoins Reign Supreme: The demand for altcoins with genuine use cases – in DeFi, NFTs, blockchain gaming, supply chain management, and more – is expected to continue. Investors are increasingly prioritizing projects that solve real-world problems or offer innovative technological solutions over those relying solely on hype.

- Evolution of Airdrop Strategies: Airdrops will likely continue as a marketing tool, but expect them to become more targeted and sophisticated. Projects might focus on rewarding active users of their platform or those who contribute to their ecosystem, rather than broad, unsolicited distributions. The potential for airdrop scams will remain, underscoring the need for due diligence.

For investors, the key takeaway from events like the Safemoon Drama is the critical importance of research. Understanding a project’s tokenomics, development team, community engagement, and underlying technology is paramount. Diversification across different types of altcoins, from utility tokens to more established meme coins with a growing ecosystem, can also help mitigate risk. The future of crypto innovation is bright, but navigating it requires a data-driven, risk-aware approach.

Conclusion

The story of Safemoon is a compelling, albeit cautionary, tale within the dynamic world of cryptocurrency. What began as a community-driven endeavor with innovative tokenomics quickly became embroiled in controversy, culminating in the dramatic **Safemoon Drama that left many investors questioning the true value of hype-driven digital assets. We’ve explored how altcoins and meme coins operate, delved into Safemoon’s specific mechanics, analyzed critical market data, and highlighted the inherent risks involved.

The unfolding events surrounding Safemoon serve as a potent reminder that in the burgeoning crypto space, transparency, robust technology, and responsible leadership are as crucial as enthusiastic community support. While the allure of rapid gains can be powerful, it’s essential to approach altcoins with a discerning eye, prioritizing thorough research and understanding the underlying value proposition.

What are your thoughts on the Safemoon Drama? Did you invest in Safemoon, or have you had experiences with similar projects? Share your learnings and opinions in the comments below! We’re always eager to hear from our community and foster informed discussions about the ever-evolving crypto landscape.

Don’t miss out on future insights and analyses. Subscribe to our newsletter for the latest updates on cryptocurrency trends, investment strategies, and in-depth explorations of fascinating projects that are shaping the future of finance. Your journey through the crypto world is important, and we’re here to guide you!

FAQs

Q1: What exactly is Safemoon and why did it gain so much attention?

Safemoon is a cryptocurrency that launched in March 2021. It gained significant attention due to its unique tokenomics, which included static rewards (distributing a portion of transaction fees to holders) and a manual burn mechanism (permanently removing tokens from circulation). This, combined with aggressive social media marketing and community engagement, led to a meteoric rise in price and popularity, especially during the meme coin craze.

Q2: What were the main allegations in the Safemoon Drama?

The Safemoon Drama involved several serious allegations, including accusations of a “rug pull” (though the team largely denied this), mismanagement of funds, lack of transparency regarding the project’s development and treasury, and internal disputes among founders that led to key personnel departures. These issues raised significant concerns about the project’s integrity and the safety of investor funds.

Q3: Are all meme coins scams?

No, not all meme coins are scams, but they are inherently high-risk investments. While some meme coins, like Dogecoin and Shiba Inu, have developed significant communities and are exploring various forms of utility, their value is still primarily driven by speculation and social media trends. Many meme coins are created with legitimate intentions but lack long-term viability, while others are outright scams designed to defraud investors. It is crucial to conduct thorough due diligence on any meme coin before investing.

Q4: How can I protect myself from crypto scams like potential Safemoon scam scenarios?

Protecting yourself involves several key practices:

- Research Thoroughly: Understand the project, its team, its technology, and its tokenomics. Look for whitepapers, roadmaps, and active development.

- Verify the Team: Research the founders and key team members. Are they doxxed (publicly known)? Do they have a track record?

- Beware of Hype: Be skeptical of promises of guaranteed high returns or projects that rely solely on social media hype.

- Check for Transparency: Look for open communication, regular updates, and clear information about how funds are managed.

- Understand Smart Contracts: Be aware of potential vulnerabilities in smart contracts, especially for newer projects.

- Use Secure Wallets: Never share your private keys or seed phrases.

- Start Small: Only invest what you can afford to lose, especially in high-risk altcoins and meme coins.

Q5: What is the difference between an altcoin and a meme coin?

An altcoin is any cryptocurrency other than Bitcoin. This is a broad category that includes many different types of digital assets with various purposes and technologies. A meme coin is a type of altcoin that is often inspired by internet memes or jokes. Their value is typically driven more by community sentiment and viral marketing than by underlying technological innovation or utility, although some meme coins aim to develop these aspects over time.