Are you tired of watching Bitcoin and Ethereum hog the crypto spotlight while exciting, high-growth potential assets fly under the radar? In a market often dominated by the giants, have you ever wondered how the savvy investor diversifies their Crypto Portfolio to capture explosive gains from lesser-known, yet fundamentally promising, altcoins and the ever-surging meme coin sector? If you’re looking to go beyond the established players and uncover the next wave of digital asset innovation, you’re in the right place. This is your guide to strategically identifying and acquiring top altcoin and meme coin opportunities that can significantly enhance your Crypto Portfolio.

Crypto Market Overview

The cryptocurrency market is a dynamic, ever-evolving ecosystem, and currently, we’re witnessing fascinating shifts. While Bitcoin and Ethereum remain the undisputed leaders, the altcoin market is buzzing with activity. Recent data indicates a significant uptick in investor interest in projects offering innovative solutions in decentralized finance (DeFi), non-fungible tokens (NFTs), and Layer 1 and Layer 2 scaling technologies.

Meme coins, often born from internet culture and community-driven hype, have also proven to be more than just a fleeting trend. Their ability to generate massive rallies and attract new demographics into the crypto space cannot be ignored. We’re seeing a pattern where well-managed meme coin projects, backed by strong communities and utility development, are solidifying their presence.

Key market indicators show increased volatility, but also greater opportunities for savvy investors. The total market capitalization of cryptocurrencies continues to fluctuate, influenced by macroeconomic factors and regulatory news, but the underlying technological advancements across various altcoins are driving organic growth. Airdrop campaigns, too, are playing a crucial role in distributing tokens and fostering community engagement, making them a valuable element to consider for any diversified Crypto Portfolio.

The Core Concept: How Altcoins & Meme Coins Actually Work

What Are Altcoins / Meme Coins / Airdrops?

Let’s demystify these terms. Altcoins, short for “alternative coins,” refer to any cryptocurrency other than Bitcoin. They emerged as developers sought to improve upon Bitcoin’s perceived limitations or to explore entirely new use cases for blockchain technology. Think of them as the innovative siblings of Bitcoin, each with its own unique purpose, technology stack, and community.

Meme coins, on the other hand, are a more recent phenomenon. They are cryptocurrencies that are often inspired by internet memes, jokes, or popular culture. While their origins might seem frivolous, many meme coins have evolved to incorporate robust technological features and strong community governance, turning viral internet phenomena into functional digital assets. Their value is often driven by social media sentiment and widespread community adoption.

Airdrops, in the blockchain world, are a promotional strategy used by crypto projects to distribute tokens to their community. This typically happens in exchange for performing a small task, such as holding a certain amount of another cryptocurrency, following their social media channels, or engaging with their platform. Airdrops are a fantastic way to acquire new tokens for free, which can then be added to your Crypto Portfolio or traded.

Key Components & Technologies

The technological backbone of most altcoins and meme coins lies in blockchain technology. This distributed ledger system provides the foundation for secure, transparent, and decentralized transactions. Altcoins leverage various consensus mechanisms, such as Proof-of-Stake (PoS) or Proof-of-Work (PoW), each with its own advantages in terms of energy efficiency and scalability.

Many altcoins are building sophisticated ecosystems around concepts like Decentralized Finance (DeFi). DeFi aims to recreate traditional financial services like lending, borrowing, and trading on decentralized networks, offering greater accessibility and transparency. Projects focusing on DeFi often involve smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

For meme coins, while the underlying blockchain might be standard (often built on platforms like Ethereum or Binance Smart Chain), the innovation often lies in their governance models, community engagement strategies, and token utility. Some meme coins are introducing features like staking, decentralized exchanges (DEXs), and even play-to-earn gaming elements to create sustainable value and utility beyond their meme status.

The Data-Driven Perspective

Market Data & Trends

The altcoin market’s performance can be highly correlated with Bitcoin’s price action, but also exhibits its own unique trends. Historically, during bull markets, altcoins tend to outperform Bitcoin as investors seek higher returns and explore emerging technologies. Conversely, during bear markets, investors often retreat to the perceived safety of Bitcoin and Ethereum.

Analyzing market data reveals interesting patterns. For instance, projects focusing on layer-2 scaling solutions have seen significant growth as the Ethereum network faces congestion. Similarly, DeFi tokens have experienced surges in value as more users flock to decentralized financial services. For meme coins, momentum is often fueled by social media trends and influencer endorsements. Data points like trading volume, market capitalization growth, and community engagement metrics are crucial for identifying potential winners.

Consider the resurgence of certain meme coins that have actively developed their ecosystems. Projects that have integrated real-world utility, such as payment solutions or decentralized applications (dApps), often demonstrate more sustained growth compared to those relying solely on hype.

Tokenomics & Market Health

Understanding tokenomics is paramount when evaluating any cryptocurrency for your Crypto Portfolio. Tokenomics refers to the economic design of a cryptocurrency, encompassing aspects like total supply, circulating supply, distribution mechanisms, and inflation/deflationary policies.

For altcoins, strong tokenomics often involve well-defined use cases for the token within its ecosystem, such as paying for transaction fees, staking for network security, or participating in governance. A limited or decreasing supply, combined with increasing demand, can drive up the token’s value.

Meme coins can present a mixed bag. Some have an infinite supply, making their value purely driven by demand, while others have fixed supplies with burning mechanisms (where tokens are permanently removed from circulation) to create scarcity. Analysing the distribution of tokens among holders is also important. A highly concentrated ownership can pose a risk of price manipulation. Healthy tokenomics foster long-term sustainability and encourage community participation.

Risks, Challenges & Competition

Risks of Altcoins and Meme Coins

Investing in altcoins and meme coins, while potentially rewarding, carries significant risks that every investor must understand.

- Volatility: Similar to Bitcoin, altcoins and meme coins are highly volatile. Their prices can experience dramatic swings in short periods, leading to substantial losses. Meme coins, in particular, are known for their extreme price fluctuations driven by speculative trading and social media sentiment.

- Security Vulnerabilities: Newer projects might have less robust security measures, making them susceptible to hacks and exploits. Smart contract bugs can lead to the loss of funds.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still developing. New regulations could impact the value and legality of certain altcoins or meme coins.

- Project Failure: Many altcoin projects fail to gain traction or deliver on their promises. A lack of development, poor management, or insufficient funding can lead to a project’s demise.

- “Pump and Dump” Schemes: Meme coins, especially, are often targets for coordinated “pump and dump” schemes where a group artificially inflates the price through aggressive buying and promotion, only to sell their holdings at a profit, leaving other investors with losses.

How Does [TOPIC] Stack Up Against Competitors?

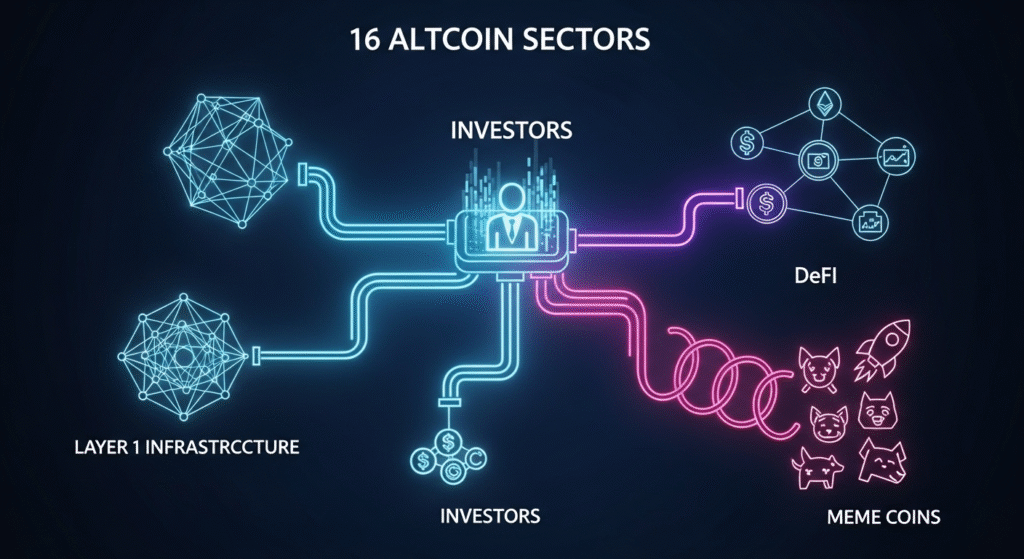

To illustrate the diversity within the altcoin and meme coin space, let’s consider how different categories stack up:

| Cryptocurrency Sector | Key Differentiators | Strengths | Weaknesses |

|---|---|---|---|

| Layer 1 / Infrastructure | Scalability, transaction speed, smart contract capabilities | Foundation for dApps, potential for widespread adoption, technological innovation | High competition, complex development cycles, network congestion issues |

| DeFi Tokens | Decentralized lending, borrowing, trading, yield farming | Financial innovation, user control, passive income opportunities | Smart contract risk, impermanent loss, regulatory scrutiny, complex to use |

| Meme Coins | Community-driven, viral marketing, often low entry barrier | High potential for rapid gains, strong community engagement, accessibility | Extreme volatility, lack of intrinsic value, susceptibility to manipulation |

| Utility Tokens | Access to specific services/products within an ecosystem | Clear use case, growth tied to project adoption, potential for real-world utility | Dependent on the success of the underlying platform, competition from similar services |

When building your Crypto Portfolio, understanding these nuances is crucial. For instance, a robust Altcoin portfolio might include a mix of solid infrastructure projects, promising DeFi tokens, and perhaps a small allocation to a well-vetted meme coin with a strong community and development roadmap.

The Future Outlook

What’s Next for Altcoins / Meme Coins / Airdrops?

The future of altcoins and meme coins appears to be one of continued evolution and specialization. We can expect to see more projects focusing on:

- Interoperability: Solutions that allow different blockchains to communicate seamlessly will become increasingly important, fostering a more connected crypto ecosystem.

- Scalability Solutions: As more users enter the crypto space, the demand for faster and cheaper transactions will drive innovation in Layer 2 solutions and new blockchain architectures.

- Real-World Asset Tokenization: Bringing real-world assets like real estate, art, and commodities onto the blockchain is a significant growth area, with altcoins likely to play a key role in facilitating this.

- Enhanced Utility for Meme Coins: While hype will surely remain a factor, successful meme coins will continue to integrate tangible utility, build robust communities, and potentially even feature in decentralized autonomous organizations (DAOs) for governance.

- Sophisticated Airdrop Strategies: Projects will likely refine their airdrop strategies to target specific user demographics and reward genuine engagement, making them even more valuable for accumulating new assets for your Crypto Portfolio.

The trend towards decentralization and user empowerment is undeniable. As these technologies mature, altcoins and meme coins are poised to unlock new possibilities across finance, gaming, art, and various industries.

Conclusion

Diversifying your Crypto Portfolio with carefully selected altcoins and meme coins can be a powerful strategy for growth. While Bitcoin and Ethereum are foundational, the potential for outsized returns often lies in exploring these alternative digital assets. Remember to conduct thorough research, understand the inherent risks, analyze tokenomics, and never invest more than you can afford to lose.

What are your favorite altcoins or meme coins shaping your Crypto Portfolio? Share your thoughts in the comments below! For more insights into smart crypto investments and to stay updated on the latest trends, be sure to subscribe to our newsletter.

FAQs

Q1: What is the safest way to start investing in altcoins?

A1: The safest approach is to start with smaller, established altcoins that have proven utility and strong development teams. Begin with an amount you are comfortable losing, and always conduct your own research (DYOR). Using reputable exchanges and secure wallets is also crucial.

Q2: How do I identify promising meme coins?

A2: Look for meme coins with active and engaged communities, clear utility (even if nascent), transparent development teams, and reasonable tokenomics. Social media sentiment is a factor, but fundamental development should be a key consideration. Avoid projects with anonymous teams and little to no roadmap.

Q3: Are airdrops taxable?

A3: Tax regulations regarding cryptocurrencies, including airdrops, vary by jurisdiction. In many places, receiving an airdrop may be considered taxable income at the fair market value of the tokens when received. It is essential to consult with a qualified tax professional in your region.

Q4: How much of my portfolio should be in altcoins and meme coins?

A4: This is highly personal and depends on your risk tolerance, investment goals, and overall financial situation. A common strategy for beginners is to allocate a smaller percentage of their portfolio to altcoins and meme coins, with the majority in more established cryptocurrencies, increasing the allocation as their understanding and comfort level grow.

Q5: What does “DYOR” mean in crypto?

A5: DYOR is an acronym for “Do Your Own Research.” It’s a constant reminder in the crypto community that investors should not rely solely on the advice of others but should independently investigate and understand any cryptocurrency before investing.