Tired of missing out on free crypto? Dive into Meme Airdrops with our 5 secrets to maximize your free tokens. Discover smart tips today! Have you ever scrolled through crypto news and felt like everyone else was snagging free digital assets while you were left on the sidelines, wondering how they did it? In the rapidly evolving world of digital currencies, the concept of “free” often comes with a hidden catch, but Meme Airdrops are a genuine pathway to acquiring new digital assets without upfront investment. But how do you navigate this exciting space effectively and actually come away with valuable tokens? Let’s unlock the secrets to maximizing your gains from these often-overlooked opportunities.

Riding the Wave: A Crypto Market Snapshot

The cryptocurrency market is a perpetual motion machine, constantly shifting and innovating. While Bitcoin and Ethereum often dominate headlines, the ecosystem is brimming with thousands of altcoins, each with unique potential and purpose. Recently, we’ve seen a significant surge in interest around meme coins, driven by social media trends, community engagement, and the inherent “gamification” of crypto. This has, in turn, fueled a parallel rise in associated airdrops, where new meme coins distribute tokens to early adopters and community members to foster awareness and decentralization. Understanding the current market sentiment, particularly the fervor surrounding meme coins, is crucial for identifying potentially lucrative airdrop opportunities.

The Core Concept: How Meme Airdrops Actually Work

At their heart, Meme Airdrops are a marketing and distribution strategy employed by cryptocurrency projects, particularly those focusing on meme culture and community building. They are a way to get new tokens into the hands of potential users and supporters, thereby increasing awareness, decentralization, and potentially driving adoption.

What Are Altcoins, Meme Coins, and Airdrops?

Before we dive into the specifics of maximizing Meme Airdrops, let’s clarify the fundamental terms:

Altcoins: Short for “alternative coins,” altcoins are any cryptocurrencies other than Bitcoin. This is a vast category encompassing everything from established smart contract platforms like Ethereum and Solana to niche utility tokens and, of course, meme coins. They often aim to improve upon Bitcoin’s design or offer different functionalities, such as faster transaction speeds, lower fees, or specialized applications in areas like decentralized finance (DeFi) or non-fungible tokens (NFTs).

Meme Coins: Meme coins are a sub-category of altcoins characterized by their origin or inspiration from internet memes, jokes, or online trends. They often lack the fundamental utility or complex technological innovation of many other altcoins. Instead, their value is primarily driven by community enthusiasm, social media virality, and speculative trading. Think of Dogecoin, born from a popular internet meme of a Shiba Inu dog, or Shiba Inu itself, which built a massive community and even launched its own ecosystem. The success of these coins highlights the power of community in the crypto space.

Airdrops: In the crypto context, an airdrop is the distribution of a cryptocurrency token or coin, free of charge, to a wallet address. This is usually done as a promotional strategy to build a user base, incentivize specific actions, or reward existing holders of another cryptocurrency. For meme coins, airdrops are a common way to kickstart their community and generate early buzz without needing to go through lengthy or expensive initial coin offerings (ICOs). They can be as simple as holding a certain amount of another token, joining a Telegram group, or participating in social media campaigns.

Key Components & Technologies

While meme coins may seem like simple jokes, they are built upon the same foundational blockchain technologies that power more established cryptocurrencies.

Blockchain Technology: Like Bitcoin and Ethereum, meme coins operate on decentralized ledger technology (blockchain). This means transactions are recorded on a distributed network of computers, making them transparent, secure, and immutable. The specific blockchain a meme coin is built on can influence its transaction speed, fees, and scalability. Many meme coins reside on popular blockchains like Binance Smart Chain (BSC), Solana, or Polygon, chosen for their lower transaction fees and faster processing times compared to Ethereum’s mainnet, though Ethereum remains a dominant platform.

Smart Contracts: Many meme coins utilize smart contracts, particularly those built on platforms like Ethereum or BSC. These are self-executing contracts with the terms of the agreement directly written into code. For airdrops, smart contracts can automate the process of token distribution based on predefined criteria (e.g., wallet addresses that meet certain holding requirements or have performed specific tasks). This ensures fairness and efficiency in the distribution process.

Tokenomics: The underlying tokenomics of a meme coin are crucial, even if its primary appeal is cultural. This includes the total supply of tokens, distribution mechanisms, potential burning mechanisms (removing tokens from circulation to reduce supply), and any staking or yield-farming opportunities. Understanding these elements helps gauge the long-term viability and potential value of the tokens received through an airdrop.

The Data-Driven Perspective: Unlocking Airdrop Value

While luck plays a role, a data-driven approach can significantly enhance your success rate and the value of the tokens you receive from Meme Airdrops.

Market Data & Trends in Free Meme Tokens

The past few years have seen a dramatic increase in the number of Free meme tokens available through airdrops. Data from various crypto analytics platforms indicates a clear trend:

- Increased Airdrop Volume: The number of new tokens being launched via airdrops has surged, particularly on newer, more cost-effective blockchains. This means more opportunities, but also a greater need for discernment.

- Hyper-Growth Potential: While highly speculative, some meme coins that started as airdrops have experienced explosive growth, often driven by intense community building and viral marketing. For example, early airdrop participants in projects that later gained widespread recognition could see returns of hundreds or even thousands of percent.

- Community as a Key Indicator: Data analysis of social media mentions, Telegram/Discord group growth, and engagement levels can often precede significant price pumps for meme coins. Projects with active, engaged communities are more likely to succeed and their airdrops can be more valuable.

- Blockchain Popularity: The choice of blockchain matters. Airdrops on established, secure, and widely adopted blockchains like Ethereum (ERC-20 tokens) or Binance Smart Chain (BEP-20 tokens) might indicate a more serious project than those on obscure or unproven networks.

Tokenomics & Market Health Analysis

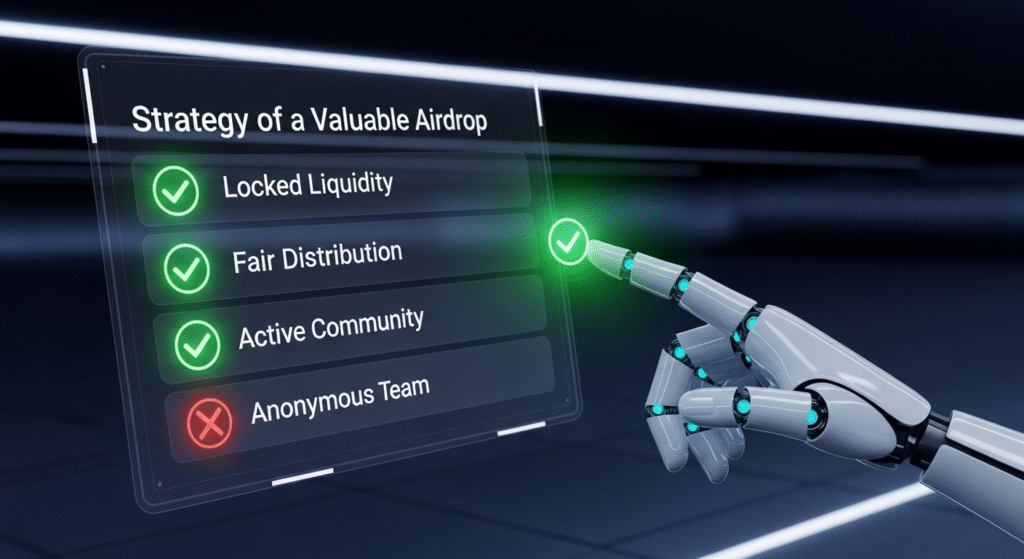

When evaluating a Meme Airdrop, digging into the tokenomics is paramount:

- Total Supply and Circulating Supply: A massive total supply can dilute your holdings if not managed carefully. However, some projects implement token-burning mechanisms to counteract this, increasing scarcity and potentially price.

- Distribution Fairness: How are the tokens being distributed? Are they concentrated in a few wallets, or spread widely among airdrop participants? A more decentralized distribution is generally healthier for the long-term growth of a meme coin’s ecosystem.

- Utility (Even if Minimal): Even meme coins often have some claimed utility, whether it’s for governance, access to exclusive content, or simply as a store of community pride. Understanding this can help you gauge potential network effects.

- Liquidity: For an airdropped token to have tangible value, it needs to be listed on exchanges with sufficient liquidity. Projects that quickly establish liquidity pools on decentralized exchanges (DEXs) like PancakeSwap or Uniswap are more accessible for trading.

Risks, Challenges, and the Competitive Landscape

Navigating the world of Meme Airdrops is not without its pitfalls. Awareness of the risks and challenges is essential for protecting yourself and maximizing your genuine opportunities.

Risks of Altcoins and Meme Coins

- Extreme Volatility: Meme coins are notoriously volatile. Their prices can skyrocket based on speculation and hype, but they can also crash just as quickly if sentiment shifts or the community loses interest. This makes them highly speculative investments.

- Scams and Rug Pulls: The low barrier to entry for many new tokens, especially those with airdrop campaigns, attracts scammers. “Rug pulls” occur when developers abandon a project after attracting investment, making off with user funds. Always be wary of projects that seem too good to be true or have opaque development teams.

- Security Vulnerabilities: While the underlying blockchain is secure, the smart contracts governing the token or the airdrop process itself can sometimes have vulnerabilities, leading to potential loss of funds.

- Lack of Intrinsic Value or Utility: Many meme coins are built on hype alone and have no underlying technology or genuine use case. Their value is purely speculative, making them susceptible to market whims.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies, particularly for meme coins and DeFi tokens, is still evolving. New regulations could impact the value or legality of certain assets.

How Do Meme Airdrops Stack Up Against Competitors?

Comparing Meme Airdrops to other methods of acquiring crypto reveals distinct pros and cons:

| Feature | Meme Airdrops | Staking | Yield Farming | Initial Coin Offerings (ICOs) / IDOs |

|---|---|---|---|---|

| Cost to Entry | Low to none (often requires small network fees) | Requires holding existing crypto assets | Requires holding existing crypto assets | Typically requires purchase of new tokens |

| Risk Level | High (speculative, scam potential) | Moderate (dependent on asset volatility) | High (complex strategies, impermanent loss) | High (new projects, regulatory risk) |

| Potential Reward | High (if project succeeds) | Moderate (passive income) | High (high APYs, but also high risk) | High (early access to promising projects) |

| Learning Curve | Moderate (understanding tokenomics, scams) | Low to Moderate (simple staking vs. advanced) | High (understanding LP, impermanent loss) | Moderate to High (project research) |

| Time Commitment | Low to Moderate (following tasks) | Low (once set up) | Moderate to High (actively managing positions) | Moderate (research and participation) |

| Target Audience | Newcomers, community builders, risk-tolerant | Existing crypto holders | DeFi users, experienced traders | Investors, traders looking for early growth |

| Example | Receiving free tokens for joining a Telegram | Staking SOL to earn more SOL | Providing liquidity to a trading pair on Uniswap | Buying tokens during a new project’s launch |

As you can see, Meme Airdrops offer a unique pathway for users to enter the crypto space with minimal upfront capital, but they come with a higher risk profile due to their speculative nature and the prevalence of scams.

The Future Outlook: What’s Next for Meme Airdrops?

The future of Meme Airdrops is intrinsically linked to the broader evolution of the cryptocurrency market. As blockchain technology matures and new applications emerge, airdrops will likely continue to be a vital tool for project growth.

What’s Next for Meme Coins and Their Airdrops?

- Increased Sophistication: As the market matures, we can expect to see more innovative airdrop mechanisms. Projects might incorporate more complex engagement strategies, such as gamified tasks, participation in decentralized autonomous organizations (DAOs), or even proof-of-humanity checks to ensure fair distribution and deter bots.

- Utility-Focused Meme Coins: While much of the early meme coin craze was driven by pure speculation, there’s a growing trend towards meme coins with some form of underlying utility or ecosystem integration. This could lead to airdrops of tokens that grant access to DeFi services, gaming platforms, or NFT marketplaces, making them inherently more valuable.

- Sustainability and Community Governance: Projects that focus on long-term sustainability and community governance are more likely to survive and thrive. We may see airdrops that reward active community participation and contributions, fostering a stronger, more invested user base.

- Integration with NFTs and Metaverse: The lines between meme coins, NFTs, and the metaverse are blurring. Future airdrops might involve both tokens and unique digital collectibles, offering a multi-faceted engagement opportunity for users.

- Regulatory Scrutiny: As the meme coin market capitalization grows, it will inevitably attract more regulatory attention. This could lead to clearer guidelines for airdrop distribution and increased accountability for project developers.

Conclusion: Your Map to Maximizing Meme Airdrop Gains

Navigating the landscape of Meme Airdrops can be a rewarding experience, offering a chance to acquire new digital assets without initial investment. We’ve explored the fundamentals, the data-driven strategies, and the inherent risks. By understanding how these airdrops work, analyzing tokenomics, focusing on community strength, and always being vigilant against scams, you can significantly increase your chances of success.

Remember, the key lies in informed participation. Don’t chase every airdrop; be selective, do your research, and prioritize projects that demonstrate genuine potential, even within the often-whimsical world of meme coins.

What are your favorite Meme Airdrops or strategies for finding them? Share your experiences and tips in the comments below! If you found this guide helpful, consider sharing it with a friend who’s looking to explore the exciting world of free crypto. And don’t forget to subscribe for more in-depth crypto guides and market analysis!

Frequently Asked Questions About Meme Airdrops

Q1: How do I find legitimate Meme Airdrops?

A: Legitimate airdrops are often announced on the project’s official social media channels (Twitter, Telegram, Discord), crypto news websites, and dedicated airdrop listing platforms. Always verify the authenticity of announcements by cross-referencing information and checking official project websites.

Q2: What are the common requirements for participating in a Meme Airdrop?

A: Common requirements can include holding another specific cryptocurrency, joining the project’s Telegram or Discord channels, following them on Twitter, referring friends, or performing simple tasks on their website. Be wary of any airdrop that asks for your private keys or requests a significant upfront payment beyond network transaction fees.

Q3: Can I receive tokens from multiple airdrops?

A: Yes, you can participate in as many airdrops as you qualify for. However, it’s crucial to manage your participation and not get overwhelmed. Focus on airdrops from projects that genuinely interest you or show strong potential.

Q4: How do I claim my airdropped tokens once they are distributed?

A: The claiming process varies. Sometimes, tokens are automatically sent to your wallet for which you met the criteria (e.g., holding a specificToken). Other times, you might need to visit the project’s website, connect your wallet, and initiate a claim transaction. Always refer to the official project instructions.

Q5: What should I do if a Meme Airdrop asks for my private keys?

A: NEVER share your private keys with anyone or any website for any reason, including airdrops. Your private keys are the master key to your crypto. Legitimate airdrops will never ask for them. Requesting private keys is a classic sign of a scam. Always connect your wallet through trusted interfaces only.