Have you ever scrolled through your crypto portfolio after a promising “moonshot” only to find your hard-earned altcoins have vanished, leaving you with nothing but a sinking feeling and a deleted Telegram group? In the exhilarating, yet often treacherous, world of digital assets, how can you truly safeguard your investments from the ever-evolving landscape of Meme Scams? It’s a question many are asking, especially as the allure of quick gains in meme coins and speculative altcoins continues to draw in both seasoned traders and eager newcomers. The reality is, while innovation thrives, so do predatory tactics, making awareness and vigilance your most powerful tools. This guide will equip you with seven crucial secrets to navigate these volatile waters and protect your precious altcoins.

The cryptocurrency market is a vibrant ecosystem, constantly churning with new projects, innovative technologies, and, unfortunately, individuals looking to exploit the unwary. Understanding the nuances of this dynamic environment is the first step toward financial security in the digital age.

Crypto Market Overview

The cryptocurrency market is currently a fascinating dichotomy of explosive growth and sobering corrections. While Bitcoin and Ethereum often dominate headlines, the real buzz for many investors lies in the altcoin sector. We’ve witnessed incredible surges in meme coins like Dogecoin and Shiba Inu, which, despite their often meme-driven origins, have garnered significant market capitalization and a dedicated following. This has, in turn, spurred a wave of new meme coin projects, each promising the next big surge.

Simultaneously, the proliferation of Decentralized Finance (DeFi) has opened up new avenues for earning and interacting with cryptocurrencies, often through novel altcoins and governance tokens. Airdrops, a common promotional tool where free tokens are distributed to existing holders or active participants, also remain a popular, albeit sometimes exploited, way to acquire new digital assets. Market indicators show continued interest in smaller-cap altcoins with innovative use cases, but this also attracts scammers eager to capitalize on the FOMO (Fear Of Missing Out). Volatility remains the defining characteristic, with prices capable of swinging dramatically within short periods, making it crucial to approach all investments with a clear understanding of the risks involved. This is where knowing how to spot Rug Pulls becomes paramount.

The Core Concept: How Altcoins and Meme Coins Actually Work

While the term “altcoin” broadly refers to any cryptocurrency other than Bitcoin, the ecosystem has diversified immensely. Meme coins and many altcoins operate on similar underlying principles but differ significantly in their genesis and perceived utility.

What Are Altcoins / Meme Coins / Airdrops?

Altcoins are essentially alternative cryptocurrencies that emerged after Bitcoin. They aim to improve upon Bitcoin’s design, offer different functionalities, or cater to specific niches. Examples range from Ethereum, with its smart contract capabilities, to privacy-focused coins like Monero, and platform coins that power decentralized applications.

Meme coins are a sub-category of altcoins that gained popularity due to internet memes and their often lighthearted, community-driven nature. While some, like Dogecoin, have achieved mainstream recognition and a degree of utility, many are launched with little to no intrinsic value, relying heavily on social media hype and community sentiment to drive demand. Their value is often speculative and highly susceptible to market manipulation.

Airdrops are a marketing strategy used by cryptocurrency projects to distribute tokens to a wide audience, usually for free. This can be done by rewarding existing holders of another cryptocurrency or by asking participants to perform certain tasks, such as following social media accounts or joining a Telegram group. While often a legitimate way to gain exposure to new projects, airdrops can also be used as a front for scams, where malicious actors collect user data or trick participants into interacting with compromised smart contracts.

Key Components & Technologies

The backbone of most altcoins and meme coins is blockchain technology. This distributed, immutable ledger records all transactions across a network of computers. This decentralization ensures transparency and resistance to censorship.

Smart Contracts: Many altcoins, particularly those built on platforms like Ethereum (ERC-20 tokens) or Binance Smart Chain (BEP-20 tokens), utilize smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. They automate processes, enabling functionalities like token creation, distribution, and swapping on decentralized exchanges (DEXs). Scammers often exploit vulnerabilities in smart contract code or use them to create deceptive mechanisms like hidden fees or exit strategies.

Decentralized Finance (DeFi): This burgeoning sector aims to recreate traditional financial services (lending, borrowing, trading) on a decentralized, blockchain-based infrastructure. Many new altcoins serve as governance tokens or utility tokens within DeFi platforms. The rapid innovation in DeFi also presents fertile ground for scams, as users may interact with unvetted protocols or tokens with poorly designed tokenomics.

The Data-Driven Perspective

To truly understand the landscape and identify potential pitfalls, a data-driven approach is crucial. Ignoring the facts in favor of hype is a common, and often costly, mistake.

Market Data & Trends

The altcoin market cap has seen periods of rapid expansion, significantly outperforming Bitcoin during certain bull cycles. For instance, during the 2021 bull run, many smaller altcoins experienced gains of thousands of percent. However, this also correlated with a dramatic increase in the number of failed projects and Rug Pulls. Data from analytics firms shows that a significant percentage of new tokens launched on platforms like DEXs are either scams or fail within months of launch. The volatility of meme coins is particularly stark; many can surge 100% or more in a day, only to crash back down just as quickly, decimating initial investments for those who bought at the peak. Airdrops, while potentially rewarding, also present a risk; the success rate of airdropped tokens becoming valuable is statistically low, and many are designed to lure users into phishing attacks.

Tokenomics & Market Health

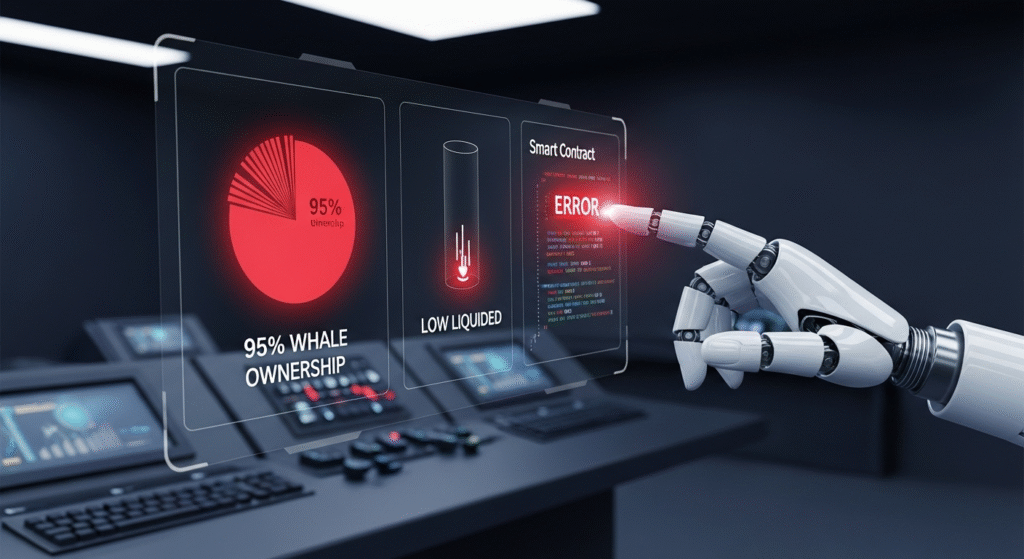

Tokenomics refers to the economics of a cryptocurrency, encompassing its supply, distribution, utility, and any built-in mechanisms that affect its value. Analyzing tokenomics is a critical defense against Meme Scams.

Total Supply & Circulating Supply: A high total supply doesn’t inherently mean a token is bad, but a rapidly inflating supply without corresponding demand can be a red flag. Conversely, a very small circulating supply can make a token susceptible to price manipulation.

Distribution: How are tokens distributed? Are they heavily concentrated in the hands of a few early investors or the development team? A large percentage held by a few individuals creates a risk of them selling off their holdings (a “dump”) at any moment, crashing the price.

Utility: Does the altcoin or meme coin have a real-world use case, or is its value solely based on speculation and community hype? Projects with clear utility and adoption are generally more sustainable. Many meme coins, by their very nature, lack inherent utility.

Vesting Schedules: For tokens allocated to the team or early investors, are there vesting schedules in place? This means tokens are released gradually over time, preventing a sudden sell-off. The absence of vesting is a significant warning sign.

Transaction Taxes & Fees: Some tokens implement transaction taxes, where a small percentage of each buy or sell is redistributed to holders or burned (removed from circulation). While this can incentivize holding, overly aggressive taxes (e.g., 50% on sell orders) are often a hallmark of scams designed to trap liquidity.

A healthy tokenomic model fosters sustainable growth and aligns the interests of the community with the project’s success. Projects with poor or overly complex tokenomics, especially those that are difficult to understand, are often designed to obscure ill-intentions.

Risks, Challenges & Competition

The allure of altcoins and meme coins is undeniable, but they come with a significant risk profile. Understanding these risks is the first line of defense against Meme Scams.

Risks of Altcoins and Meme Coins

Extreme Volatility: As mentioned, prices can skyrocket and plummet with little warning. This makes them unsuitable for risk-averse investors.

Security Vulnerabilities: Smart contracts can have bugs or exploitable flaws. Scammers can exploit these to drain liquidity pools or steal tokens. Even legitimate projects can suffer from hacks.

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies, especially newer altcoins and meme coins, is still evolving. Governments worldwide are scrutinizing these assets, which could lead to sudden changes in accessibility or legality.

Lack of Intrinsic Value: Many meme coins and speculative altcoins have no underlying asset or real-world utility. Their value is driven purely by market sentiment and speculation. When the hype dies down, the value often disappears completely.

Liquidity Issues: Smaller altcoins and meme coins often have low trading volume and liquidity. This means it can be difficult to sell your holdings without significantly impacting the price, especially if the price is falling rapidly.

Scams and Fraud: This is the most significant risk. Rug Pulls, phishing attempts, fake airdrops, pump-and-dump schemes, and malicious token contracts are rampant in this space.

How Do Altcoins and Meme Coins Stack Up Against Competitors?

Feature Bitcoin (BTC) Ethereum (ETH) Newer Altcoins (e.g., Solana, Cardano) Meme Coins (e.g., Dogecoin, Shiba Inu)

Purpose Digital Gold, Store of Value, Peer-to-Peer Payments Smart Contracts Platform, dApp Foundation, DeFi Enabler Scalable Smart Contracts, Faster Transactions, Specific Ecosystems Community-driven, Hype-driven, Speculative

Technology Proof-of-Work (PoW) Proof-of-Stake (PoS) (post-Merge) Various consensus mechanisms (PoS, PoH), Interoperability focus Typically ERC-20 or BEP-20 tokens on established blockchains

Market Cap Highest Second Highest Varies widely, can be significant for major players Varies widely, can be significant for prominent ones

Volatility High High High Extremely High

Utility Store of Value, Limited Direct Usage Wide range: DeFi, NFTs, DAOs, Gaming Developing: DeFi, NFTs, DApps, specific industry solutions Primarily speculative, community engagement, limited functional utility

Risk Profile High (Market Volatility) High (Market Volatility, Gas Fees, Smart Contract Risks) High (Market Volatility, newer tech risks, execution challenges) Extremely High (Scams, extreme volatility, lack of intrinsic value)

Scam Potential Low for core asset, higher for associated scams Low for core asset, higher for DeFi protocols and token launches on the chain Moderate for core asset, higher for projects built on the chain Very High (Frequent Rug Pulls, pump-and-dumps)

This table highlights that while altcoins often offer more advanced features than Bitcoin, they also introduce new layers of complexity and risk. Meme coins, however, represent the highest risk due to their lack of fundamentals and heavy reliance on speculative interest, making them prime targets for Meme Scams.

The Future Outlook

What’s Next for Altcoins / Meme Coins / Airdrops?

The future of altcoins and meme coins is a hotly debated topic. For altcoins with genuine utility and strong development teams, the future looks promising. As blockchain technology matures and finds broader applications in various industries, altcoins that solve real-world problems, offer efficient solutions, or drive innovation in sectors like DeFi, NFTs, and the metaverse are likely to thrive. We can expect continued development in scalability solutions, interoperability between different blockchains, and increasing institutional adoption of select altcoins.

Meme coins will likely continue to exist as a niche within the crypto market. Their future depends heavily on community engagement and the ability of their creators to foster sustained interest, potentially by introducing some form of utility or governance. However, the high risk of volatility and susceptibility to manipulation means they will remain speculative assets. The regulatory scrutiny will undoubtedly increase, potentially impacting how they are traded and marketed, which could lead to a weeding out of many of the riskier projects.

Airdrops will undoubtedly persist as a marketing tool. However, as scams become more sophisticated, users will need to be more discerning about which airdrops they participate in. Legitimate projects will likely focus on airdrops that reward genuine community involvement and the use of their platform, rather than simple social media follows. Expect a greater emphasis on security and verification within airdrop campaigns to build trust.

Conclusion

The world of altcoins and meme coins offers immense opportunities but is fraught with perils, particularly the pervasive threat of Meme Scams. By arming yourself with knowledge and employing a diligent, data-driven approach, you can significantly enhance your ability to protect your altcoins. Remember these seven secrets to avoid losing your hard-earned crypto:

Do Your Own Research (DYOR): Never invest based on hype alone. Investigate the project, the team, the whitepaper, and the community.

Analyze Tokenomics Critically: Understand supply, distribution, utility, and vesting schedules. Look for red flags like overly concentrated ownership or complex, opaque metrics.

Beware of Unrealistic Promises: If it sounds too good to be true, it almost certainly is. Huge, guaranteed returns are a classic scam indicator.

Scrutinize Smart Contracts and Liquidity: For DeFi tokens, check if liquidity is locked for a substantial period. Look for audited smart contracts from reputable firms. Be wary of tokens with high burn rates or liquidity taxes that make selling difficult – common in Rug Pulls.

Verify Airdrop Sources: Only participate in airdrops from officially verified project channels. Never share your private keys or seed phrases. Be suspicious of any airdrop that requires you to send crypto first.

Protect Your Wallet with Best Practices: Use hardware wallets for significant holdings, enable two-factor authentication, and be cautious of connecting your wallet to unknown dApps or websites.

Stay Informed and Adapt: The crypto landscape is constantly changing. Keep up-to-date with industry news, emerging scam tactics, and security best practices.

By integrating these principles into your crypto journey, you can navigate the exciting but risky altcoin and meme coin markets with greater confidence and security.

What are your thoughts on the current state of meme coins? Have you encountered any Meme Scams? Share your experiences and tips in the comments below! For more insights into secure crypto trading and investment strategies, be sure to subscribe to our newsletter and explore our other articles on [link to related content 1] and [link to related content 2].

FAQs

Q1: What is a “rug pull” in cryptocurrency?

A: A rug pull is a type of scam where developers illicitly pull liquidity from a decentralized exchange (DEX) after promoting a cryptocurrency token. This causes the token’s price to plummet to zero, and the scammers abscond with the investors’ funds.

Q2: How can I tell if a meme coin is a scam?

A: Look for signs like a lack of transparency from the development team, no clear utility beyond hype, extremely high transaction taxes that make selling difficult, a very small percentage of liquidity locked on DEXs, and aggressive marketing tactics promising unrealistic returns. Always refer to our 7 secrets above.

Q3: Is it safe to connect my wallet to a new DeFi platform?

A: Connecting your wallet to new platforms carries risk. Always use reputable platforms with strong security audits and community trust. Ideally, use a separate, “burner” wallet with only a small amount of funds for testing new protocols.

Q4: What are the best practices for securing my altcoins?

A: Utilize hardware wallets for offline storage of significant amounts. Enable two-factor authentication on all exchanges and platforms. Be wary of phishing attempts and never share your private keys or seed phrase.

Q5: Are all airdrops legitimate?

A: No, not all airdrops are legitimate. Scammers often use fake airdrop campaigns to steal personal information or trick users into interacting with malicious smart contracts. Always verify the source and never send crypto to claim an airdrop.

Meme Scams: 7 Secrets to Avoid Losing Altcoins

Have you ever scrolled through your crypto portfolio after a promising “moonshot” only to find your hard-earned altcoins have vanished, leaving you with nothing but a sinking feeling and a deleted Telegram group? In the exhilarating, yet often treacherous, world of digital assets, how can you truly safeguard your investments from the ever-evolving landscape of Meme Scams? It’s a question many are asking, especially as the allure of quick gains in meme coins and speculative altcoins continues to draw in both seasoned traders and eager newcomers. The reality is, while innovation thrives, so do predatory tactics, making awareness and vigilance your most powerful tools. This guide will equip you with seven crucial secrets to navigate these volatile waters and protect your precious altcoins.

The cryptocurrency market is a vibrant ecosystem, constantly churning with new projects, innovative technologies, and, unfortunately, individuals looking to exploit the unwary. Understanding the nuances of this dynamic environment is the first step toward financial security in the digital age.

Crypto Market Overview

The cryptocurrency market is currently a fascinating dichotomy of explosive growth and sobering corrections. While Bitcoin and Ethereum often dominate headlines, the real buzz for many investors lies in the altcoin sector. We’ve witnessed incredible surges in meme coins like Dogecoin and Shiba Inu, which, despite their often meme-driven origins, have garnered significant market capitalization and a dedicated following. This has, in turn, spurred a wave of new meme coin projects, each promising the next big surge.

Simultaneously, the proliferation of Decentralized Finance (DeFi) has opened up new avenues for earning and interacting with cryptocurrencies, often through novel altcoins and governance tokens. Airdrops, a common promotional tool where free tokens are distributed to existing holders or active participants, also remain a popular, albeit sometimes exploited, way to acquire new digital assets. Market indicators show continued interest in smaller-cap altcoins with innovative use cases, but this also attracts scammers eager to capitalize on the FOMO (Fear Of Missing Out). Volatility remains the defining characteristic, with prices capable of swinging dramatically within short periods, making it crucial to approach all investments with a clear understanding of the risks involved. This is where knowing how to spot Rug Pulls becomes paramount.

The Core Concept: How Altcoins and Meme Coins Actually Work

While the term “altcoin” broadly refers to any cryptocurrency other than Bitcoin, the ecosystem has diversified immensely. Meme coins and many altcoins operate on similar underlying principles but differ significantly in their genesis and perceived utility.

What Are Altcoins / Meme Coins / Airdrops?

Altcoins are essentially alternative cryptocurrencies that emerged after Bitcoin. They aim to improve upon Bitcoin’s design, offer different functionalities, or cater to specific niches. Examples range from Ethereum, with its smart contract capabilities, to privacy-focused coins like Monero, and platform coins that power decentralized applications.

Meme coins are a sub-category of altcoins that gained popularity due to internet memes and their often lighthearted, community-driven nature. While some, like Dogecoin, have achieved mainstream recognition and a degree of utility, many are launched with little to no intrinsic value, relying heavily on social media hype and community sentiment to drive demand. Their value is often speculative and highly susceptible to market manipulation.

Airdrops are a marketing strategy used by cryptocurrency projects to distribute tokens to a wide audience, usually for free. This can be done by rewarding existing holders of another cryptocurrency or by asking participants to perform certain tasks, such as following social media accounts or joining a Telegram group. While often a legitimate way to gain exposure to new projects, airdrops can also be used as a front for scams, where malicious actors collect user data or trick participants into interacting with compromised smart contracts.

Key Components & Technologies

The backbone of most altcoins and meme coins is blockchain technology. This distributed, immutable ledger records all transactions across a network of computers. This decentralization ensures transparency and resistance to censorship.

Smart Contracts: Many altcoins, particularly those built on platforms like Ethereum (ERC-20 tokens) or Binance Smart Chain (BEP-20 tokens), utilize smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. They automate processes, enabling functionalities like token creation, distribution, and swapping on decentralized exchanges (DEXs). Scammers often exploit vulnerabilities in smart contract code or use them to create deceptive mechanisms like hidden fees or exit strategies.

Decentralized Finance (DeFi): This burgeoning sector aims to recreate traditional financial services (lending, borrowing, trading) on a decentralized, blockchain-based infrastructure. Many new altcoins serve as governance tokens or utility tokens within DeFi platforms. The rapid innovation in DeFi also presents fertile ground for scams, as users may interact with unvetted protocols or tokens with poorly designed tokenomics.

The Data-Driven Perspective

To truly understand the landscape and identify potential pitfalls, a data-driven approach is crucial. Ignoring the facts in favor of hype is a common, and often costly, mistake.

Market Data & Trends

The altcoin market cap has seen periods of rapid expansion, significantly outperforming Bitcoin during certain bull cycles. For instance, during the 2021 bull run, many smaller altcoins experienced gains of thousands of percent. However, this also correlated with a dramatic increase in the number of failed projects and Rug Pulls. Data from analytics firms shows that a significant percentage of new tokens launched on platforms like DEXs are either scams or fail within months of launch. The volatility of meme coins is particularly stark; many can surge 100% or more in a day, only to crash back down just as quickly, decimating initial investments for those who bought at the peak. Airdrops, while potentially rewarding, also present a risk; the success rate of airdropped tokens becoming valuable is statistically low, and many are designed to lure users into phishing attacks.

Tokenomics & Market Health

Tokenomics refers to the economics of a cryptocurrency, encompassing its supply, distribution, utility, and any built-in mechanisms that affect its value. Analyzing tokenomics is a critical defense against Meme Scams.

- Total Supply & Circulating Supply: A high total supply doesn’t inherently mean a token is bad, but a rapidly inflating supply without corresponding demand can be a red flag. Conversely, a very small circulating supply can make a token susceptible to price manipulation.

- Distribution: How are tokens distributed? Are they heavily concentrated in the hands of a few early investors or the development team? A large percentage held by a few individuals creates a risk of them selling off their holdings (a “dump”) at any moment, crashing the price.

- Utility: Does the altcoin or meme coin have a real-world use case, or is its value solely based on speculation and community hype? Projects with clear utility and adoption are generally more sustainable. Many meme coins, by their very nature, lack inherent utility.

- Vesting Schedules: For tokens allocated to the team or early investors, are there vesting schedules in place? This means tokens are released gradually over time, preventing a sudden sell-off. The absence of vesting is a significant warning sign.

- Transaction Taxes & Fees: Some tokens implement transaction taxes, where a small percentage of each buy or sell is redistributed to holders or burned (removed from circulation). While this can incentivize holding, overly aggressive taxes (e.g., 50% on sell orders) are often a hallmark of scams designed to trap liquidity.

A healthy tokenomic model fosters sustainable growth and aligns the interests of the community with the project’s success. Projects with poor or overly complex tokenomics, especially those that are difficult to understand, are often designed to obscure ill-intentions.

Risks, Challenges & Competition

The allure of altcoins and meme coins is undeniable, but they come with a significant risk profile. Understanding these risks is the first line of defense against Meme Scams.

Risks of Altcoins and Meme Coins

- Extreme Volatility: As mentioned, prices can skyrocket and plummet with little warning. This makes them unsuitable for risk-averse investors.

- Security Vulnerabilities: Smart contracts can have bugs or exploitable flaws. Scammers can exploit these to drain liquidity pools or steal tokens. Even legitimate projects can suffer from hacks.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies, especially newer altcoins and meme coins, is still evolving. Governments worldwide are scrutinizing these assets, which could lead to sudden changes in accessibility or legality.

- Lack of Intrinsic Value: Many meme coins and speculative altcoins have no underlying asset or real-world utility. Their value is driven purely by market sentiment and speculation. When the hype dies down, the value often disappears completely.

- Liquidity Issues: Smaller altcoins and meme coins often have low trading volume and liquidity. This means it can be difficult to sell your holdings without significantly impacting the price, especially if the price is falling rapidly.

- Scams and Fraud: This is the most significant risk. Rug Pulls, phishing attempts, fake airdrops, pump-and-dump schemes, and malicious token contracts are rampant in this space.

How Do Altcoins and Meme Coins Stack Up Against Competitors?

| Feature | Bitcoin (BTC) | Ethereum (ETH) | Newer Altcoins (e.g., Solana, Cardano) | Meme Coins (e.g., Dogecoin, Shiba Inu) |

|---|---|---|---|---|

| Purpose | Digital Gold, Store of Value, Peer-to-Peer Payments | Smart Contracts Platform, dApp Foundation, DeFi Enabler | Scalable Smart Contracts, Faster Transactions, Specific Ecosystems | Community-driven, Hype-driven, Speculative |

| Technology | Proof-of-Work (PoW) | Proof-of-Stake (PoS) (post-Merge) | Various consensus mechanisms (PoS, PoH), Interoperability focus | Typically ERC-20 or BEP-20 tokens on established blockchains |

| Market Cap | Highest | Second Highest | Varies widely, can be significant for major players | Varies widely, can be significant for prominent ones |

| Volatility | High | High | High | Extremely High |

| Utility | Store of Value, Limited Direct Usage | Wide range: DeFi, NFTs, DAOs, Gaming | Developing: DeFi, NFTs, DApps, specific industry solutions | Primarily speculative, community engagement, limited functional utility |

| Risk Profile | High (Market Volatility) | High (Market Volatility, Gas Fees, Smart Contract Risks) | High (Market Volatility, newer tech risks, execution challenges) | Extremely High (Scams, extreme volatility, lack of intrinsic value) |

| Scam Potential | Low for core asset, higher for associated scams | Low for core asset, higher for DeFi protocols and token launches on the chain | Moderate for core asset, higher for projects built on the chain | Very High (Frequent Rug Pulls, pump-and-dumps) |

This table highlights that while altcoins often offer more advanced features than Bitcoin, they also introduce new layers of complexity and risk. Meme coins, however, represent the highest risk due to their lack of fundamentals and heavy reliance on speculative interest, making them prime targets for Meme Scams.

The Future Outlook

What’s Next for Altcoins / Meme Coins / Airdrops?

The future of altcoins and meme coins is a hotly debated topic. For altcoins with genuine utility and strong development teams, the future looks promising. As blockchain technology matures and finds broader applications in various industries, altcoins that solve real-world problems, offer efficient solutions, or drive innovation in sectors like DeFi, NFTs, and the metaverse are likely to thrive. We can expect continued development in scalability solutions, interoperability between different blockchains, and increasing institutional adoption of select altcoins.

Meme coins will likely continue to exist as a niche within the crypto market. Their future depends heavily on community engagement and the ability of their creators to foster sustained interest, potentially by introducing some form of utility or governance. However, the high risk of volatility and susceptibility to manipulation means they will remain speculative assets. The regulatory scrutiny will undoubtedly increase, potentially impacting how they are traded and marketed, which could lead to a weeding out of many of the riskier projects.

Airdrops will undoubtedly persist as a marketing tool. However, as scams become more sophisticated, users will need to be more discerning about which airdrops they participate in. Legitimate projects will likely focus on airdrops that reward genuine community involvement and the use of their platform, rather than simple social media follows. Expect a greater emphasis on security and verification within airdrop campaigns to build trust.

Conclusion

The world of altcoins and meme coins offers immense opportunities but is fraught with perils, particularly the pervasive threat of Meme Scams. By arming yourself with knowledge and employing a diligent, data-driven approach, you can significantly enhance your ability to protect your altcoins. Remember these seven secrets to avoid losing your hard-earned crypto:

- Do Your Own Research (DYOR): Never invest based on hype alone. Investigate the project, the team, the whitepaper, and the community.

- Analyze Tokenomics Critically: Understand supply, distribution, utility, and vesting schedules. Look for red flags like overly concentrated ownership or complex, opaque metrics.

- Beware of Unrealistic Promises: If it sounds too good to be true, it almost certainly is. Huge, guaranteed returns are a classic scam indicator.

- Scrutinize Smart Contracts and Liquidity: For DeFi tokens, check if liquidity is locked for a substantial period. Look for audited smart contracts from reputable firms. Be wary of tokens with high burn rates or liquidity taxes that make selling difficult – common in Rug Pulls.

- Verify Airdrop Sources: Only participate in airdrops from officially verified project channels. Never share your private keys or seed phrases. Be suspicious of any airdrop that requires you to send crypto first.

- Protect Your Wallet with Best Practices: Use hardware wallets for significant holdings, enable two-factor authentication, and be cautious of connecting your wallet to unknown dApps or websites.

- Stay Informed and Adapt: The crypto landscape is constantly changing. Keep up-to-date with industry news, emerging scam tactics, and security best practices.

By integrating these principles into your crypto journey, you can navigate the exciting but risky altcoin and meme coin markets with greater confidence and security.

What are your thoughts on the current state of meme coins? Have you encountered any Meme Scams? Share your experiences and tips in the comments below! For more insights into secure crypto trading and investment strategies, be sure to subscribe to our newsletter and explore our other articles on [link to related content 1] and [link to related content 2].

FAQs

Q1: What is a “rug pull” in cryptocurrency?

A: A rug pull is a type of scam where developers illicitly pull liquidity from a decentralized exchange (DEX) after promoting a cryptocurrency token. This causes the token’s price to plummet to zero, and the scammers abscond with the investors’ funds.

Q2: How can I tell if a meme coin is a scam?

A: Look for signs like a lack of transparency from the development team, no clear utility beyond hype, extremely high transaction taxes that make selling difficult, a very small percentage of liquidity locked on DEXs, and aggressive marketing tactics promising unrealistic returns. Always refer to our 7 secrets above.

Q3: Is it safe to connect my wallet to a new DeFi platform?

A: Connecting your wallet to new platforms carries risk. Always use reputable platforms with strong security audits and community trust. Ideally, use a separate, “burner” wallet with only a small amount of funds for testing new protocols.

Q4: What are the best practices for securing my altcoins?

A: Utilize hardware wallets for offline storage of significant amounts. Enable two-factor authentication on all exchanges and platforms. Be wary of phishing attempts and never share your private keys or seed phrase.

Q5: Are all airdrops legitimate?

A: No, not all airdrops are legitimate. Scammers often use fake airdrop campaigns to steal personal information or trick users into interacting with malicious smart contracts. Always verify the source and never send crypto to claim an airdrop.